Ethereum price made a bullish breakout this week, reaching a high of $2,832, its highest level since February 4.

Ethereum (ETH) has jumped 102 percent from its lowest level in April, giving it a market capitalization of $333 billion. Currently trading at around $2,800 there are four reasons why the coin can soon rise to the $3,000 level.

1. Ethereum ETF inflows continue

Wall Street investors are aggressively buying Ethereum funds, a sign that they expect further upside. SoSoValue data shows that inflows rose by $124.9 million on June 10, bringing cumulative inflows since inception to $3.5 billion.

These fund inflows have now increased for 17 consecutive days, the longest streak on record. BlackRock’s ETHA fund has seen more than $4.97 billion in cumulative inflows and now holds $4.3 billion in assets.

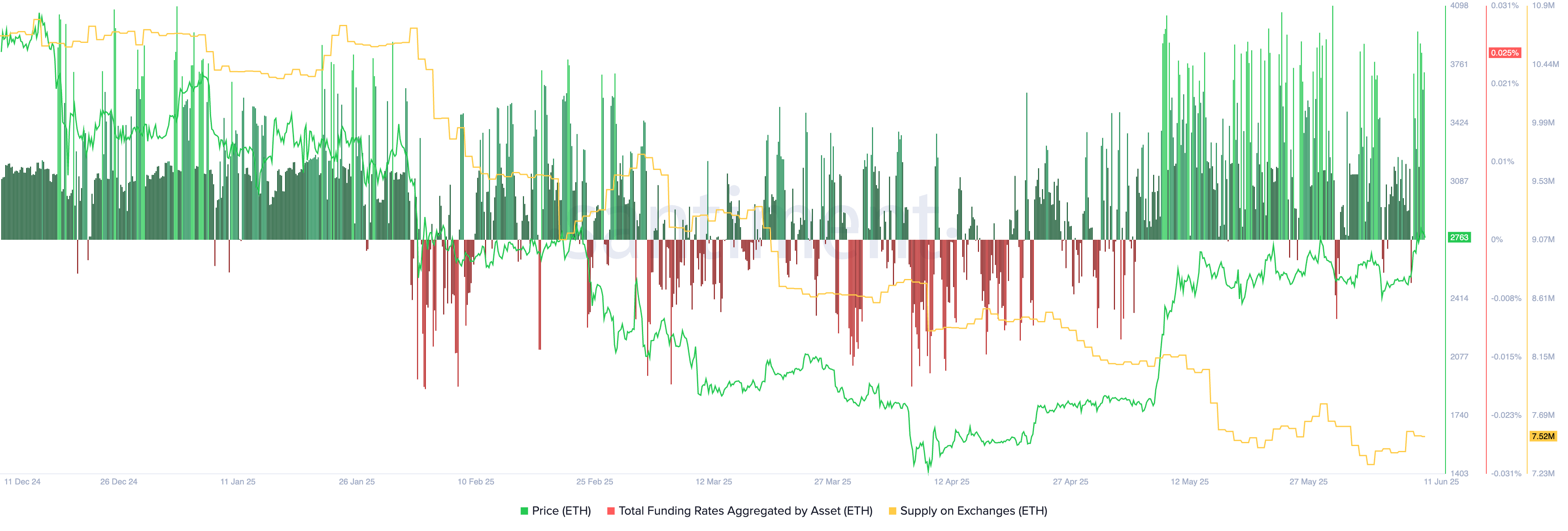

2. ETH supply on exchanges is falling

Ongoing inflows into Ethereum funds, combined with whale accumulation, have driven a sharp decline in exchange supply. There are now 7.52 million ETH on centralized exchanges, down from the year-to-date high of 10.3 million. The decline has accelerated since April, when exchange balances peaked at 8.75 million.

On-chain data shows that one account, suspected to belong to Consensys, recently bought 17,864 ETH worth $49.57 million. The account now holds over $213 million in Ethereum.

Additional on-chain data shows Ethereum’s funding rate has remained positive in recent weeks. A positive funding rate signals that traders expect the future price to remain higher than the current spot price.

3. Ethereum still leads in DeFi, RWA, and stablecoins

Ethereum continues to dominate across several core sectors of the crypto economy.

According to DeFi Llama, total value locked in Ethereum-based decentralized finance has increased 9.5 percent in the last 30 days to $143 billion. That gives Ethereum a 62 percent market dominance, well ahead of competing chains such as Solana (SOL), Tron (TRX), and Sui (SUI).

Ethereum’s stablecoin supply has grown to $125 billion, giving it a leading share in a market now worth over $250 billion.

In the tokenized real-world asset sector, Ethereum’s lead remains intact. On-chain data shows that tokenized real-world assets on Ethereum rose to $7.4 billion, the highest of any blockchain.

4. Ethereum price technical analysis

The daily chart shows that ETH bottomed at $1,368 on April 8 before surging to a high of $2,800. The coin has formed a golden cross pattern, with the 50-day moving average crossing above the 200-day average.

ETH has also formed a bullish flag pattern, comprising a vertical rally followed by a consolidation rectangle. The price has broken above the 50 percent Fibonacci retracement level at $2,738, suggesting that a move toward $3,000 remains likely.