Bitcoin’s price is approaching a critical resistance level at $118,000, which aligns with the point of control of the current trading range. A break above this level could trigger a cascade of short liquidations, potentially propelling the price to new all-time highs.

Summary

- $118K Resistance: Key point of control from current trading range.

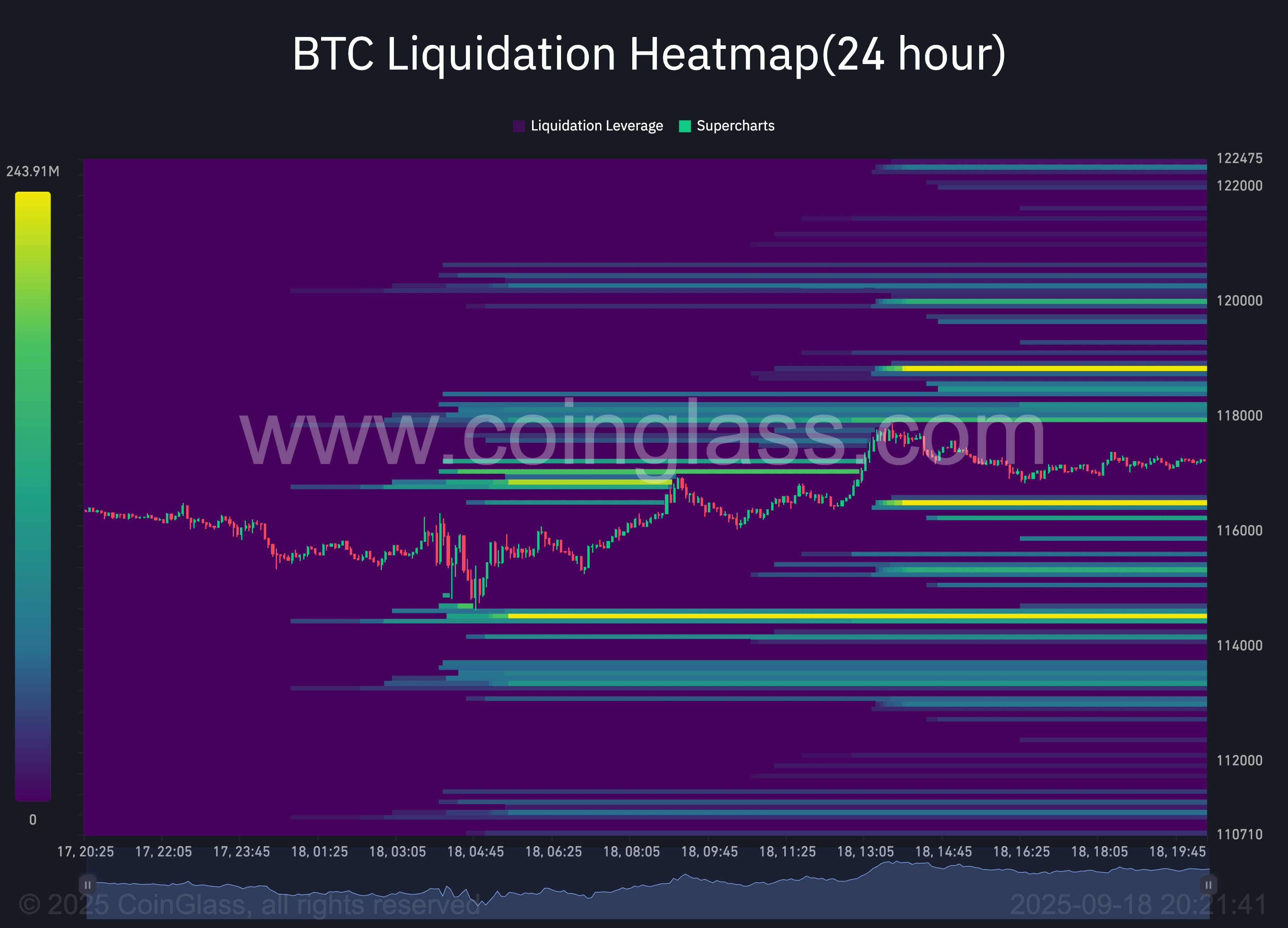

- Short Squeeze Risk: Liquidations clustered between $118K–$119K.

- Bullish Setup: Breakout could accelerate price into new all-time highs.

Bitcoin’s (BTC) action remains firmly bullish, with recent momentum driven by a bounce from the 0.618 Fibonacci retracement. This move reclaimed the value area low and set the price on a path toward the $118,000 resistance zone.

The Federal Reserve delivered its first rate cut of the year, igniting fresh optimism in risk assets and further supporting Bitcoin’s upside. With increasing derivative positioning at this level, a reclaim could spark significant volatility and initiate a short-squeeze scenario.

Bitcoin price key technical points

- $118,000 Resistance: Point of control of the current trading range since $100,000 was tested.

- Fibonacci Support: Bounce initiated from the 0.618 retracement, confirming bullish structure.

- Liquidation Cluster: Short liquidations stacked between $118,000 and $119,000 increase probability of a cascade.

The recent rebound from the 0.618 Fibonacci level has highlighted Bitcoin’s underlying strength. This retracement aligned with the reclaimed value area low, forming a technical foundation for continuation higher. Price is now testing the point of control at $118,000, a level that has concentrated volume and trading interest.

From a structural perspective, reclaiming the POC is crucial for continuation. If bulls succeed in closing above this level, Bitcoin would re-enter an area loaded with short positions, which could provide the fuel for acceleration.

The derivatives markets add another layer of importance to the $118,000 level. Liquidation heatmaps show a dense cluster of short liquidations beginning at $118,000 and extending toward $119,000. As more positions accumulate, the probability of a cascade increases if resistance is breached.

A short squeeze in this zone could propel Bitcoin above the current trading range, potentially into new all-time-high territory. Such liquidation-driven moves often accelerate rapidly, as forced covering adds momentum to existing bullish flows. Sell-pressure indicators also point to a possible vertical accumulation phase as price progresses higher.

What to expect in the coming price action

Bitcoin is primed for a decisive move as it approaches $118,000. Holding below this level may prolong consolidation, but a confirmed breakout and close above would likely trigger a liquidation cascade, accelerating the price into uncharted highs.