October seems on the verge of canceling Uptober as crypto prices retraced after a recent multi-billion-dollar liquidation. But even with that, analysts say steady ETF demand can still support a rebound.

Summary

- October started strong for Bitcoin, with ETF inflows and institutional demand pushing crypto prices to new all-time highs, following historical trends that make the month one of the best for the cryptocurrency.

- That momentum was quickly shaken when a $19 billion liquidation event, amplified by thin order books and crowded derivatives.

- But analysts say the seasonal rally isn’t dead yet.

October started like a typical Uptober, with ETF inflows pushing crypto prices higher and plenty of buyers in the market, but a sudden liquidity squeeze and a political shock quickly knocked the rally off course.

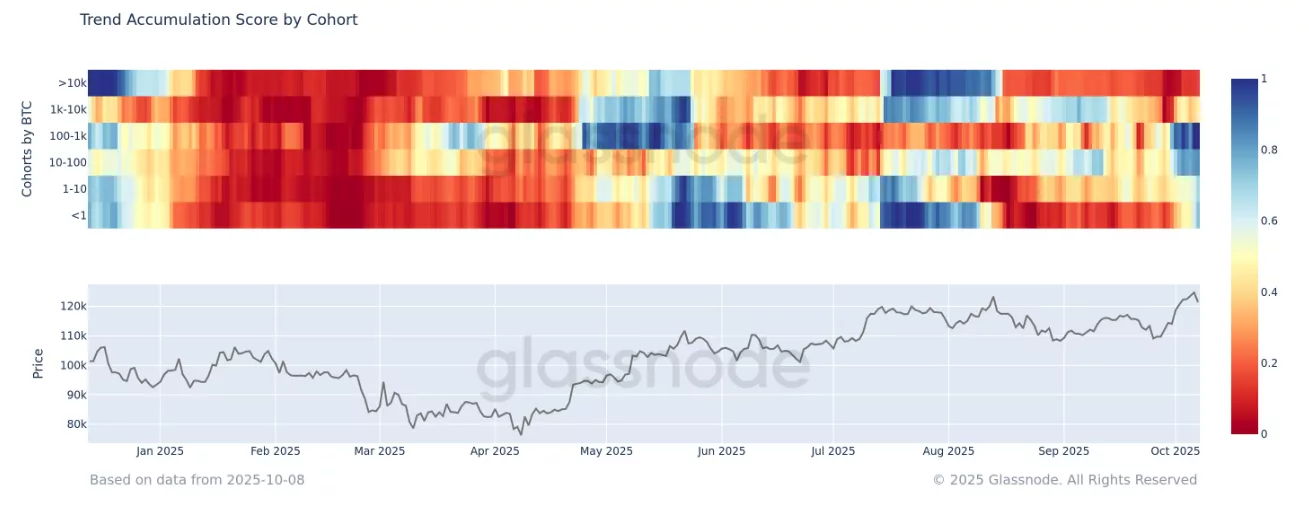

Early in the month, Bitcoin (BTC) climbed into fresh territory, with its price hitting new highs above $126,000. Analysts at Glassnode noted in a research report that Bitcoin “broke through the $114k–$117k supply zone to reach a new all-time high near $126k, backed by strong ETF inflows and renewed mid-tier accumulation.”

October has long been dubbed “Uptober” in the crypto world, a month historically known for strong gains. Data from CoinGlass shows that since 2013, Bitcoin has averaged a return of more than 46% in October, making it one of the best-performing months for the cryptocurrency.

But after the high came a shock. On Oct. 11 the market suffered the largest single-day liquidation event on record as roughly $19 billion was wiped from leveraged positions, pushing BTC as low as roughly $102,000 before a partial bounce.

Liquidity, leverage and the short squeeze

One thing some analysts noticed was that Bitcoin’s price swings weren’t just from selling as thin order books made the moves way worse. Kaiko’s mid-October note summed up the market-making side of it:

“Volumes spiked on Friday as panic swept through crypto markets, exposing a stark liquidity gap across BTC order books. As selling accelerated, there simply wasn’t enough resting depth to absorb the flow; order books on several exchanges thinned out to the point of appearing empty for several minutes across major BTC venues.”

Kaiko

Even after the flash crash, some analysts say the seasonal case isn’t over. K33 Research noted in a research piece that after this big deleveraging, they’re turning “increasingly optimistic” since excessive leverage is gone and structural risks are lower, with the market setup “now looks far healthier.”

“We view the coming weeks as an opportune window for capital deployment into BTC, expecting the reset in perps and the normalization of funding dynamics to provide a constructive foundation for renewed upside momentum.”

K33 Research

Glassnode pointed that prior to the liquidation drama, institutional demand was pretty healthy as more than $2.2 billion in U.S. spot-ETF inflows was detected in a short span and steady mid-tier accumulation made “nearly all circulating supply back into profit,” which historically marks late-stage but durable rallies.

So far, Uptober shows two things at once: big institutional flows pushed prices higher, but a single liquidity event — made worse by thin order books and crowded derivatives — can erase that progress fast.

What happens next depends less on hype and more on whether market makers, institutional buyers, and option sellers rebuild depth. If they do, Uptober could still finish strong. But if not, October will be remembered as the month the rally hit a liquidity wall and got knocked back.