OKX has released its 32nd proof-of-reserves report. As of June 14, the total BTC and USDT holdings held in user wallets have plummeted significantly compared to the previous month’s report.

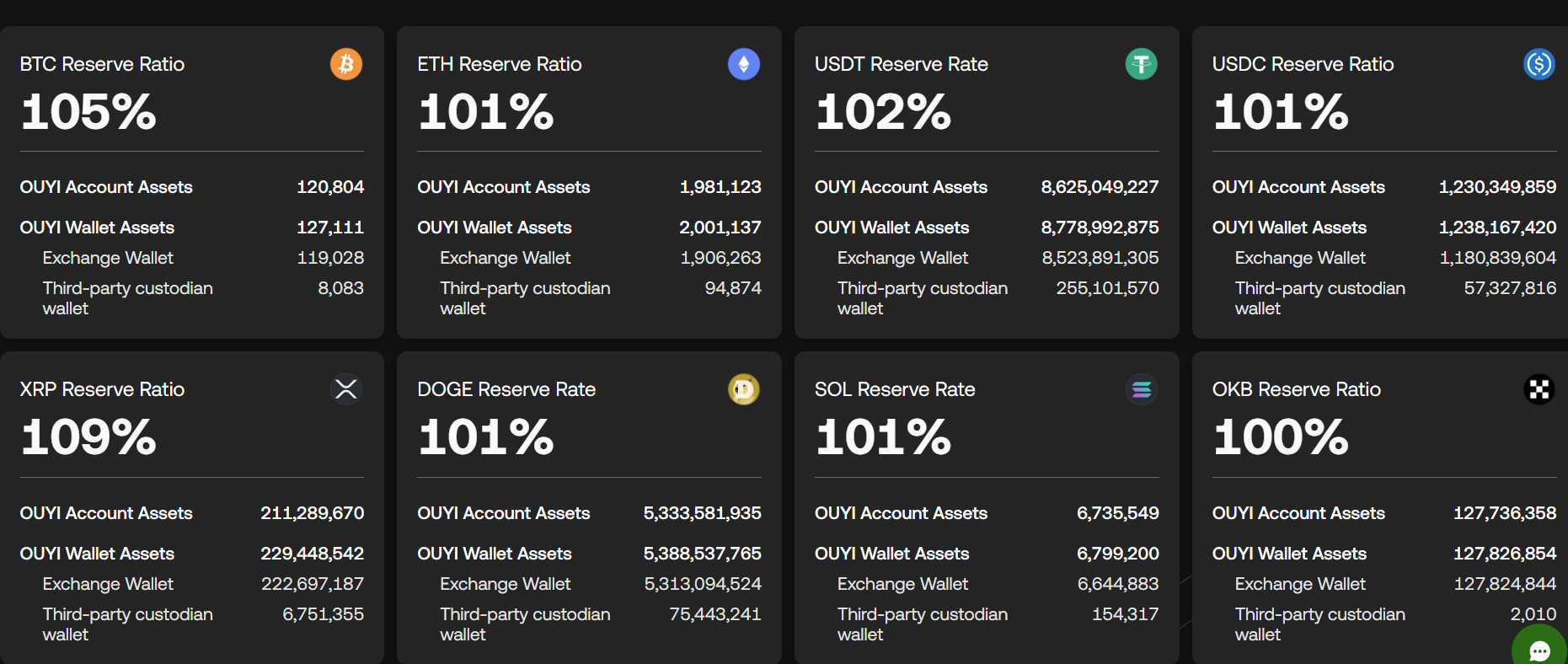

On June 30, the crypto trading platform released its 32nd proof-of-reserves report containing the number of assets held within its reserves compared to the number of assets deposited by customers. So far, all of its reserves exceed the 100% ratio. This means that the platform’s reserves for major tokens like BTC (BTC), ETH (ETH), SOL (SOL) and USDT (USDT) has surpassed the number of assets held in customer wallets.

The reserve rate for Ethereum Classic (ETC) holds the largest ratio, which stands at 107%. Meanwhile, Bitcoin remains the second largest asset by reserve to holding ratio, sitting at 105% as of June 14. However, the number of BTC held by customers has experienced a significant drop.

Compared to the previous month’s report, specifically for May 10th, the number of currently held BTC in June has decreased by 4,360 BTC or around $470 million according to current market prices. Compared to May’s customer holdings for BTC, which stood at 125,164 BTC, the number fell by 3.48%.

Aside from BTC, USDT also fell by 1.44% in June compared to the previous month. This means that the amount of USDT held by OKX users decreased by $126.4 million. Although the decline is not as steep as the drop experienced by BTC, it is still worth noting due to the boom stablecoins in the wider market as of late.

On the other hand, customer wallet holdings for Ethereum rose by nearly 6% in June. This signifies a rise of 110,153 ETH ($272.8 million) in the span of a nearly a month. The report shows that OKX users have been depositing more Ethereum into the exchange compared to Bitcoin.

What could the drop in OKX user BTC holdings mean?

The 3.48% drop in BTC holdings show that users may have chosen to withdrawn more Bitcoin from the exchange compared to the previous month. A possible reason behind this trend is the increasing number of traders keen on self-custody.

This means that users might be moving more of their BTC to cold wallets, reflecting growing concerns over exchange security or a preference for holding during uncertain market conditions. Another possibility is that some traders may be trading away their BTC holdings in favor of other assets in the wake of recent price movements.

BTC had recently recovered from its short-lived slump when Trump announced a ceasefire between Israel and Iran, bouncing back to the $105,000 mark. However, the Fed rate decision and other geopolitical uncertainties have caused Bitcoin to flatline for the most part.