Uniswap’s UNI token slumped to its lowest level in nearly a month, even as whales continued buying and the network’s volume reached a record high.

Summary

- UNI price has plunged in the past few weeks.

- Whales have continued to accumulate UNI tokens.

- Uniswap’s DEX volume jumped to a record high.

Uniswap (UNI) price dived to a low of $9.37, down by over 23% from its highest point in August. It has erased millions of dollars in value as its market capitalization has moved to $5.9 billion.

Uniswap volume hits record high as whales buy

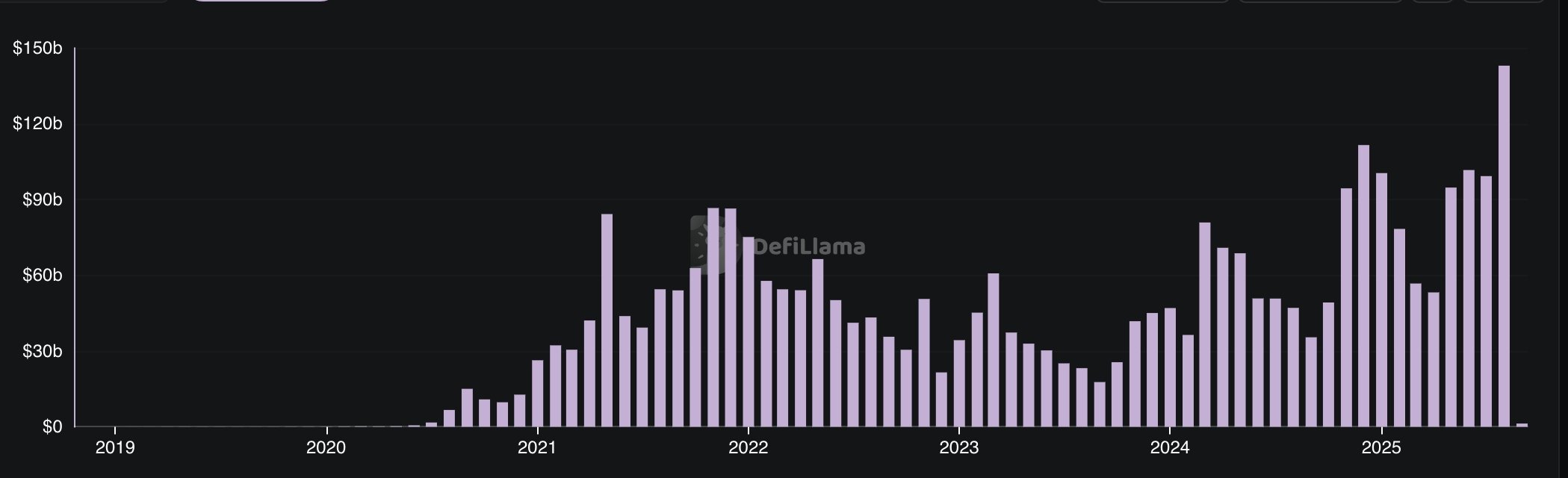

DeFi Llama data shows that Uniswap’s transaction volume jumped to a record high in August. Its transactions soared to a record $143 billion, much higher than the $99 billion.

This growth means the network has now handled more than $724 billion this year, solidifying its presence as the biggest player in the decentralized exchange industry.

Uniswap’s fees continued to grow. The protocol has generated over $273.7 million this quarter, up from $263.8 million in the previous quarter. Most notably, fees so far this quarter are much higher than the $115 million in the third quarter of last year.

Similarly, Unichain, the layer-2 network launched by Uniswap in March, continued to perform well in August. dApps on its network stood at over $12.54 billion, slightly lower than the $13.5 billion handled in July. Unichain has handled over $53 billion since its inception.

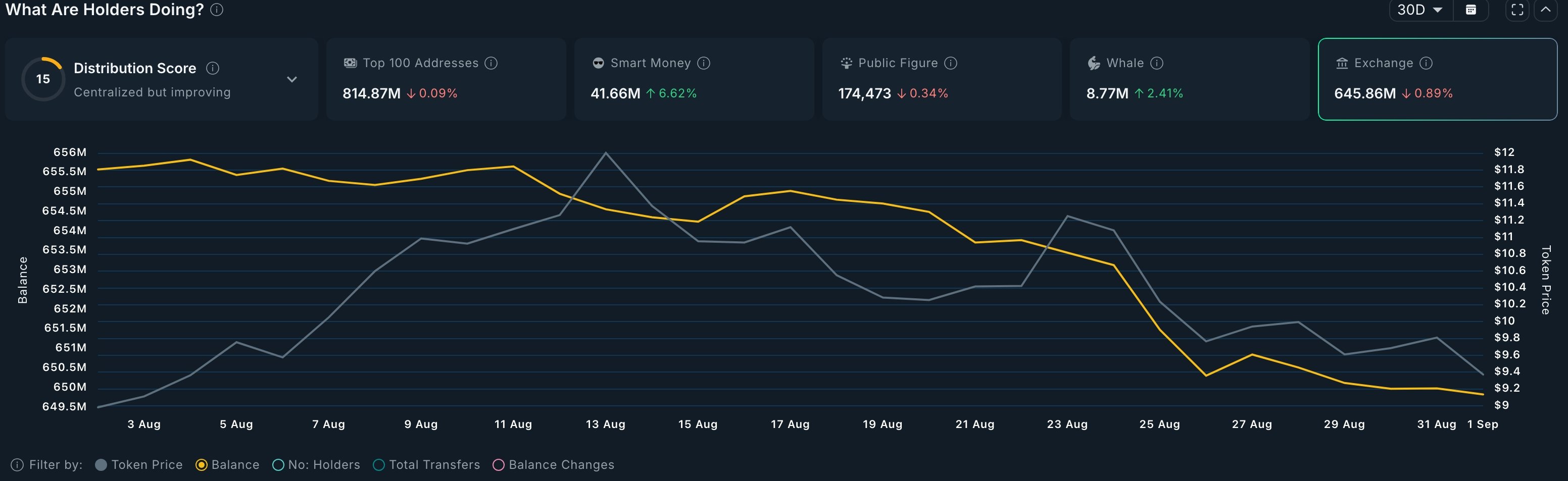

Meanwhile, whales and smart money investors have continued accumulating UNI tokens. Whales now hold over 8.77 million tokens, up from 8.26 million in August.

Smart money holds over 41.6 million tokens, while tokens on exchanges have dropped to 645 million, down from 655 million in August.

UNI price technical analysis

The daily chart shows that the UNI price has slumped from a high of $12.26 in August to $9.36 today. The token has moved to the lower side of the ascending channel.

The Uniswap token remains above the 100-day exponential moving average and the major S/R pivot point of the Murrey Math Lines tool.

Therefore, the UNI token will likely bounce back and possibly hit the upper side of the channel at $12.26, about 30% above the current level. A drop below the 100-day MA would invalidate the bullish UNI price forecast.