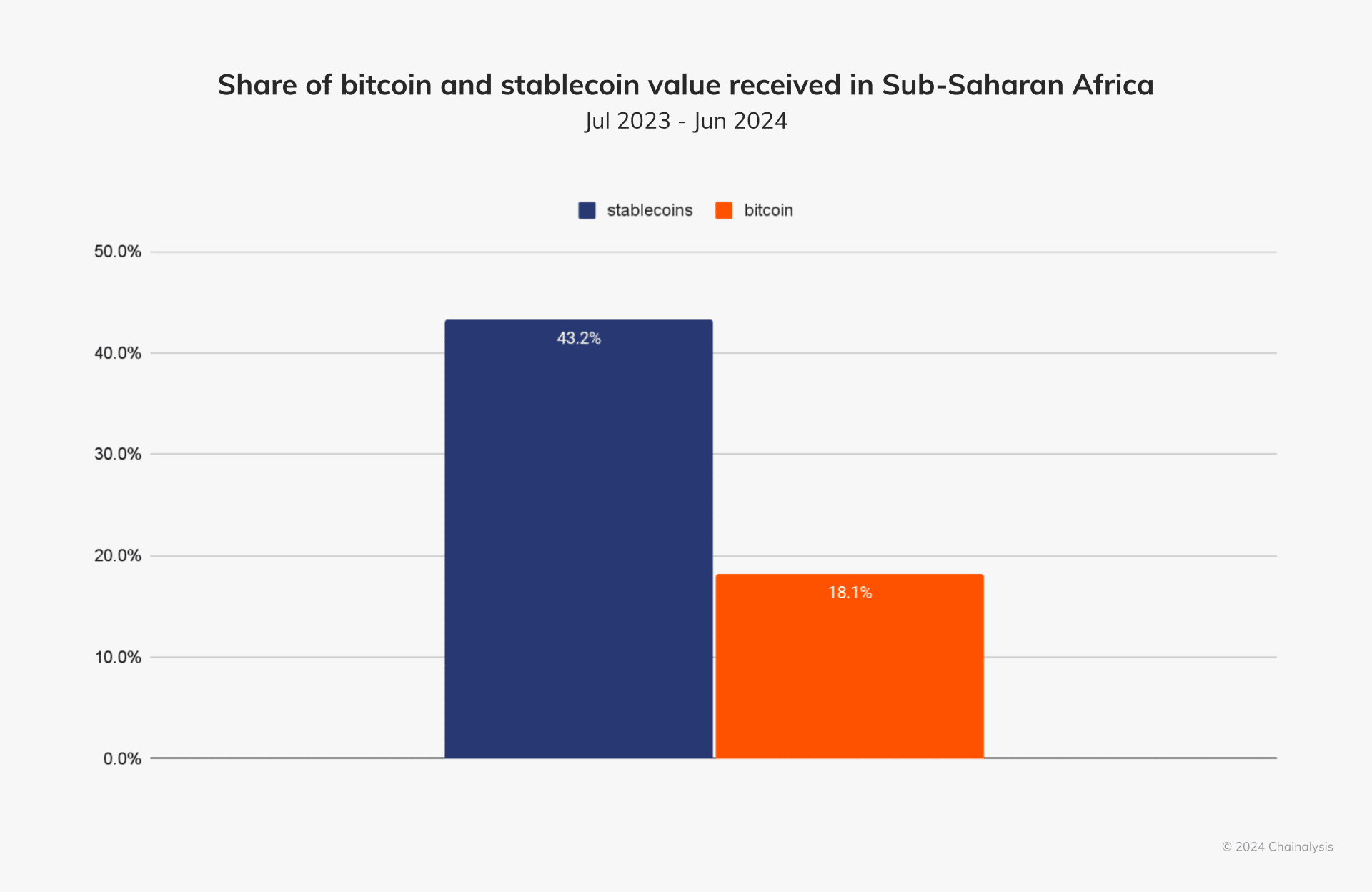

As businesses turn to dollar-pegged options, stablecoins now represent over 40% of Sub-Saharan Africa’s crypto economy.

Stablecoins have emerged as a vital component of Sub-Saharan Africa‘s crypto economy, accounting for approximately 43% of the region’s total transaction volume, according to a recent report from Chainalysis.

In nations grappling with volatile local currencies and limited access to U.S. dollars, dollar-pegged stablecoins such as Tether (USDT) and Circle (USDC) have gained prominence, enabling businesses and individuals to store value, facilitate international payments, and bolster cross-border trade.

In a commentary to Chainalysis, Yellow Card chief executive Chris Maurice said that “about 70% of African countries are facing an FX shortage, and businesses are struggling to get access to the dollars they need to operate.”

Stablecoins to become primary use case for crypto in South Africa

As a result of this struggle, Ethiopia, Africa’s second-most populous nation, has seen retail-sized stablecoin transfers grow by 180% year-over-year, fueled by a recent 30% devaluation of its local currency, the birr.

While traditional financial institutions struggle to meet the demand for U.S. dollars, stablecoins are increasingly viewed as a “proxy for the dollar,” Maurice said, adding that “if you can get into USDT or USDC, you can easily swap that into hard dollars elsewhere.”

Looking ahead, Rob Downes, head of digital assets at ABSA Bank, a major African bank operating in 12 African countries, foresees stablecoins playing a pivotal role in Africa’s economic landscape, stating that dollar-pegged tokens are going to be the “primary use case for crypto in South Africa over the next three to five years.”

From: crypto.news

Crypto News