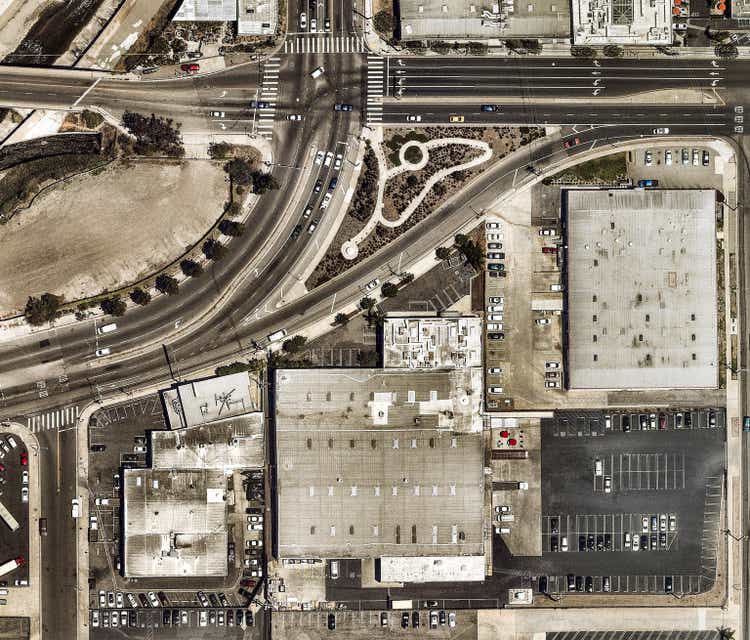

Nearmap/DigitalVision via Getty Images

Southern California industrial property markets are experiencing softness for the first time in years as cooling demand, combined with a record level of new supply, leads to higher vacancy rates and slower rent growth.

While the region’s long-term fundamentals remain strong, the slowdown is expected to remain for the near term, according to a new report from CommercialEdge, a division of real estate software firm Yardi Systems.

The average cost of a new lease declined by $1.98 per square foot in Los Angeles and by $3.37 per sf in the Inland Empire year-to-date, the report said.

In-place rent growth, though, stayed strong in the region, with rates rising by 12.4% over the last 12 months in the Inland Empire, 11.0% in Los Angeles, and 8.7% in Orange County.

The cooling represents a reversion to a more normal level after the pandemic-induced boom of 2020 and 2021, when online shopping surged.

Southern California’s normalization could hurt three other markets — Phoenix, Las Vegas, and Salt Lake City — connected to the ports by rail and acted as relief valve from sky-high rent growth of the past few years, CommercialEdge said.

The largest industrial REIT, Prologis (NYSE:PLD) mentioned the softness in its Q2 earnings call. Chief Financial Officer Tim Arndt said demand in southern California remained “sluggish and vacancy continues to drift higher.” The company expects the conditions to persist over the next year.

“Globally, we estimate that effective market rents declined 2% during the quarter, with 75% of the decline attributed to SoCal,” Arndt said.

Rexford Industrial (NYSE:REXR) focuses on smaller and medium-sized spaces within infill southern California. “Our target infill tenant base has proven to be more stable through cycles as compared to the big-box market within Southern California,” said co-CEO Michael Frankel during the company’s earnings call.

And while the long-term outlook for Rexford’s segment of the market remains very positive, “the near-term outlook for market rents may continue to reflect a nominal level of volatility,” Frankel said.

Co-CEO Howard Schwimmer said Q2 rents were down 2% from Q1, as expected, for “highly functional product comparable quality to our Rexford assets.”

He noted that a majority of vacancy in the market is typically of lower quality, older vintage, or obsolete products. Rexford (REXR) focuses on turning older vintage properties into “the most functional, highest-quality assets within their respective submarkets,” Schwimmer said.

Other industrial REITs: STAG Industrial (STAG), LXP Industrial (LXP), Gladstone Commercial (GOOD), and First Industrial Realty Trust (FR).