RAY price is poised for a 30% surge to $4.20, buoyed by Raydium’s ongoing token buybacks.

Raydium (RAY) has surged 10% in the past 24 hours, currently trading around $3.30 as it consolidates following its recent 60% rally from $2.40 to $3.86. The price structure is decisively bullish, with RAY price having printed five consecutive higher highs and higher lows. It also continues to trade above both 20 EMA and 50 SMA, which have maintained a bullish crossover since mid-April.

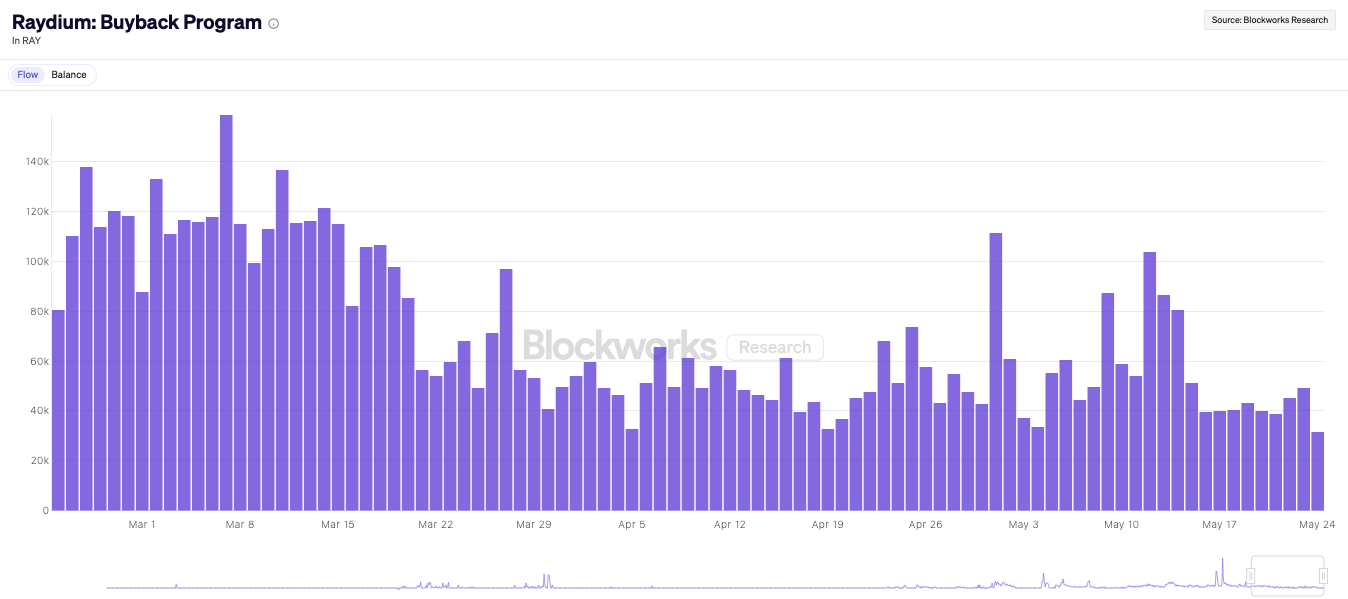

This uptrend appears to be driven by Raydium’s ongoing token buyback program, which allocates 12% of trading fees toward repurchasing RAY tokens. While buybacks have slowed since mid-March, they have been more or less steady since then with occasional spikes.

The local resistance lies at $3.50. A confirmed breakout above this level would open the door to the next key resistance at $4.20 — a key horizontal level that acted as support for multiple months before the sharp sell-off in late February. A rally to $4.20 would mark almost 30% increase from the current levels. If that’s cleared, the next major resistance is around $5.70, where the price was repeatedly rejected before and after the January rally that peaked at $8.60. The RSI sits at 58, meaning there’s room to run once the price breaks out of the current consolidation.

The bullish outlook would be invalidated if RAY drops below the $2.20 support. A break below that could send RAY down toward the $1.50 level. However, given the sustained bullish crossover between the 20 and 50 EMAs and the consistent series of higher highs and lows for nearly two months, the trend is looking strong.