After years of silence, a SpaceX-linked wallet has suddenly moved $152 million in Bitcoin, prompting fresh concerns over what it could mean for BTC’s next price move.

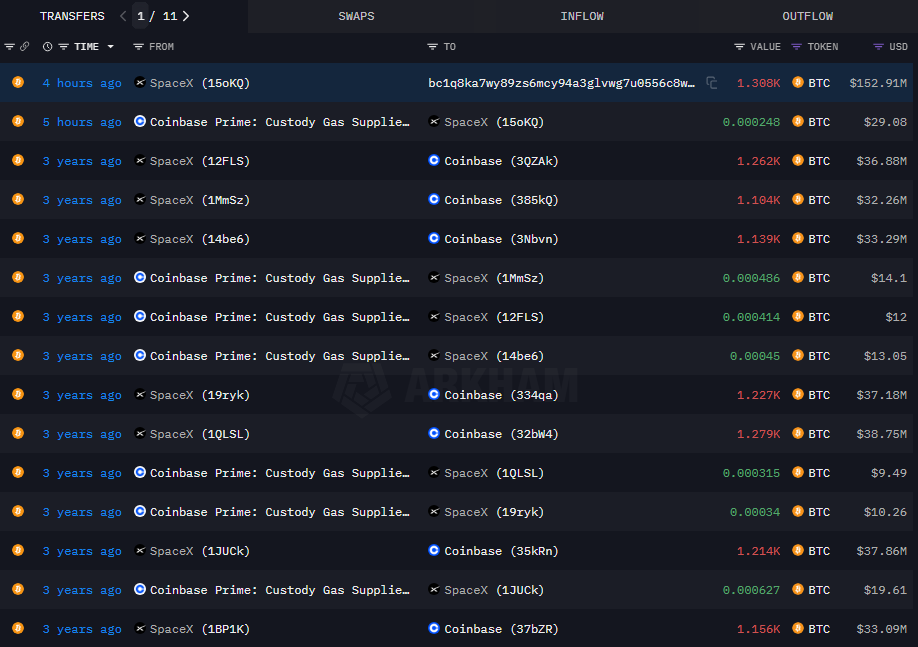

According to data from blockchain analytics platform Arkham Intelligence, on July 22, a wallet linked to Elon Musk’s multibillion-dollar space enterprise, SpaceX, had transferred 1,308.45 BTC, valued at approximately $152.91 million, to a new address.

Notably, the transfer followed after the SpaceX wallet sent a small transaction fee of 0.000248 BTC worth $29 to Coinbase Prime.

Additional data from Arkham reveal that the last time the wallet saw any movement was nearly 3 to 4 years ago when it received multiple Bitcoin inflows from Coinbase wallets, with single deposits ranging from 1,100 to 1,279 BTC.

For the uninitiated, SpaceX first made headlines in 2021 when Elon Musk publicly revealed during The ₿ Word virtual conference that the aerospace firm had been stacking Bitcoin.

While the exact amount was never disclosed, later reporting from The Wall Street Journal indicated SpaceX had written down the value of its Bitcoin holdings by approximately $373 million and sold an undisclosed portion. These events occurred following Bitcoin’s sharp decline in 2022.

On-chain activity later suggested the firm’s BTC holdings may have dropped to near zero by the end of that year, though this remains unconfirmed.

The firm then gradually rebuilt its balance, and was holding roughly 8,285 BTC by September 2024.

Following today’s large-scale transfer, SpaceX now holds approximately 6,977 BTC, valued at around $822.65 million. This places the company among the world’s largest corporate Bitcoin holders, trailing firms like MicroStrategy (MSTR) and Tesla (TSLA), another Musk-led entity. All of SpaceX’s holdings are currently custodied with Coinbase Prime.

In 2021, both SpaceX and Tesla appeared to distance themselves from Bitcoin, citing environmental concerns related to its energy usage, leading Tesla to suspend BTC payments.

However, the tech billionaire has since shifted tone. Earlier this month, Musk revealed plans to launch a new political party in the U.S., one that would explicitly support Bitcoin, signaling a renewed embrace of the asset.

As such, many are speculating that SpaceX could now be positioning itself in line with other major corporations, such as Strategy and Trump Media, that have adopted Bitcoin as part of their treasury strategy.

Will Bitcoin price crash?

As of press time, it remains unclear whether the transfer signals a sale or internal reallocation, but traders remain cautious as a potential offload could trigger fresh selling pressure.

Some market participants have downplayed the risks, suggesting the move could simply be routine housekeeping or a shift to a fresh wallet, given the absence of any official explanation.

The broader market has previously absorbed large-scale liquidations. For instance, in mid‑2024, the German government offloaded nearly 50,000 BTC, approximately $2.9 billion worth, all within a few weeks.

That move triggered an initial dip into the low‑$50,000s, but prices swiftly rebounded above $60,000 once the selling pressure subsided.

Given the current bullish backdrop, the market seems better positioned to absorb any selling pressure that may arise from the recent transfers without a prolonged impact on Bitcoin’s price trend.

When writing, Bitcoin (BTC) was trading at $118,134, down 3.7% from its all-time high. According to analysts at CryptoQuant, the flagship crypto may face some downward pressure in the short-term as retail traders are reportedly reducing exposure across markets in the U.S., South Korea, and on Binance.

However, continued whale accumulation appears to be counterbalancing some of the sell-side pressure, and technicals suggest the cryptocurrency remains in an uptrend.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.