Hyperliquid’s HYPE token jumped to a record high of $37 on Friday, May 23, continuing a trend that started on April 4 when it bottomed at $9.

Hyperliquid (HYPE) was trading at $35.50 at press time, up by 285% from its April low. Its surge has brought its market capitalization to $11.2 billion and its fully diluted valuation to $35.70 billion.

HYPE has jumped because of its rising volume, open interest, and fees in the network. DeFi LLama data shows that its seven-day volume jumped by 51% to $67.7 billion, making it the most active player in decentralized finance. In contrast, PancakeSwap and Uniswap processed transactions worth $40.2 billion and $25.26 billion in the same period.

Hyperliquid has now handled perpetual futures trades worth over $1.53 trillion, much higher than Jupiter’s $309 billion. Jupiter is the second-biggest perpetual futures exchange.

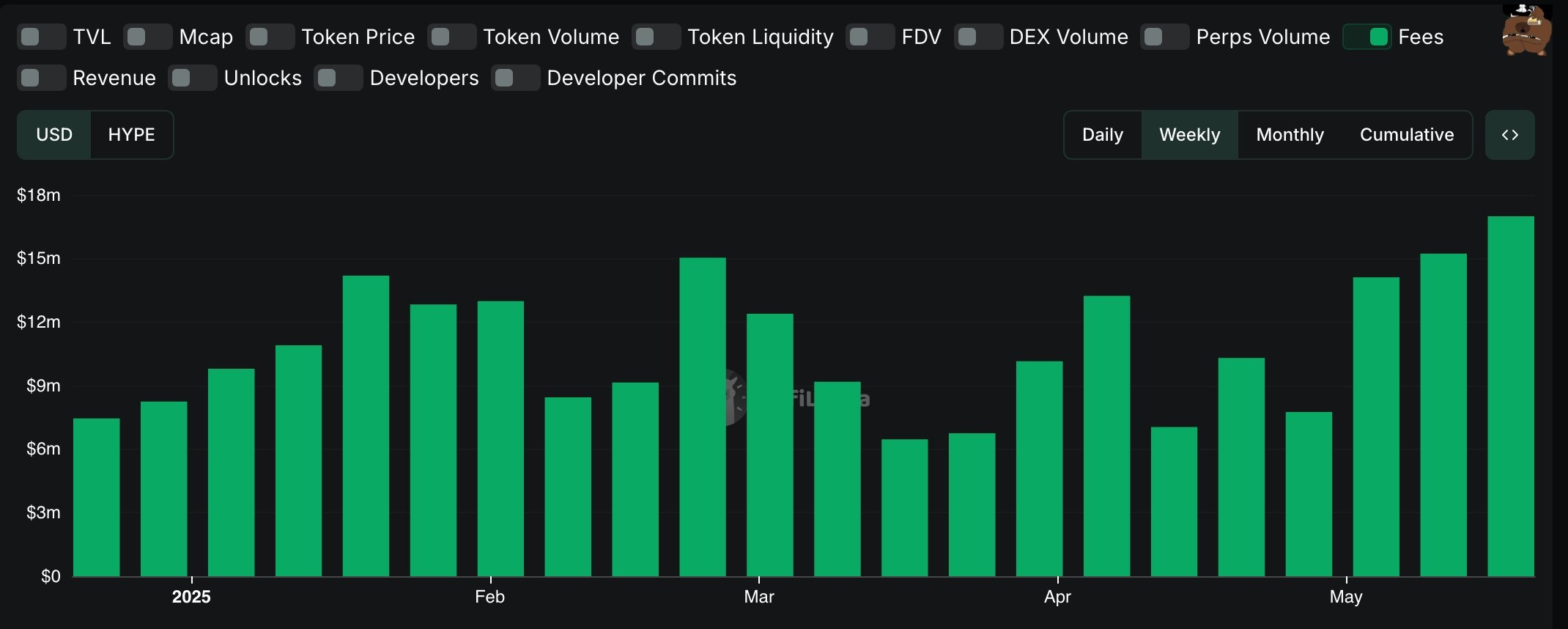

This growth has led to a surge in open interest and fees in the network. DeFi Llama data shows that its weekly fees jumped to a record high of $17 million. Its fees have risen in the last four consecutive weeks.

The recent surge in volume and fees happened as the crypto bull run started, with Bitcoin (BTC) price soaring to a record high on Thursday. Bitcoin’s surge triggered more gains among altcoins.

Perpetual futures have become highly popular in the crypto industry. These futures products resemble those in the stock market, with the only difference being that they don’t have an expiry date. They are popular because they allow traders to use leverage and amplify their returns.

Top companies in the crypto industry have started offering these products. Most recently, Coinbase acquired Deribit to increase its presence in the sector.

HYPE price technical analysis

Technicals suggest that the HYPE price has more gains to go. On the eight-hour chart, the token has formed a cup-and-handle pattern, comprising a horizontal support, a rounded bottom, and some consolidation.

This cup had a depth of about 67%. Therefore, by measuring the same distance from its upper side, the target price comes to $47, which is about 35% above the current level. Such a move will bring HYPE’s market cap to almost $15 billion.