Despite growing buzz around crypto, only 3% of central banks plan to hold Bitcoin reserves over the next decade, according to OMFIF’s latest survey.

Bitcoin (BTC) may be gaining traction globally, but only a sliver of central banks are planning to hold it, according to this year’s Global Public Investor survey by OMFIF shared with crypto.news. The report found that only 3% of central banks foresee building a strategic Bitcoin reserve in the next decade. Outside of that small group, interest in crypto as a reserve asset remains limited.

“Central banks’ cautious approach despite Bitcoin’s growing legitimacy as a digital asset has to do with a mix of volatility, regulatory uncertainty, and structural conservatism,” Shawn Young, chief analyst at MEXC Research, told crypto.news.

“Central banks tend to prioritize stability and liquidity, all the qualities that Bitcoin, despite its resilience, still doesn’t consistently offer yet. The price swings of Bitcoin can pose balance sheet risks that could be hard to justify for institutions with the sole objective to safeguard national economies.”

Shawn Young

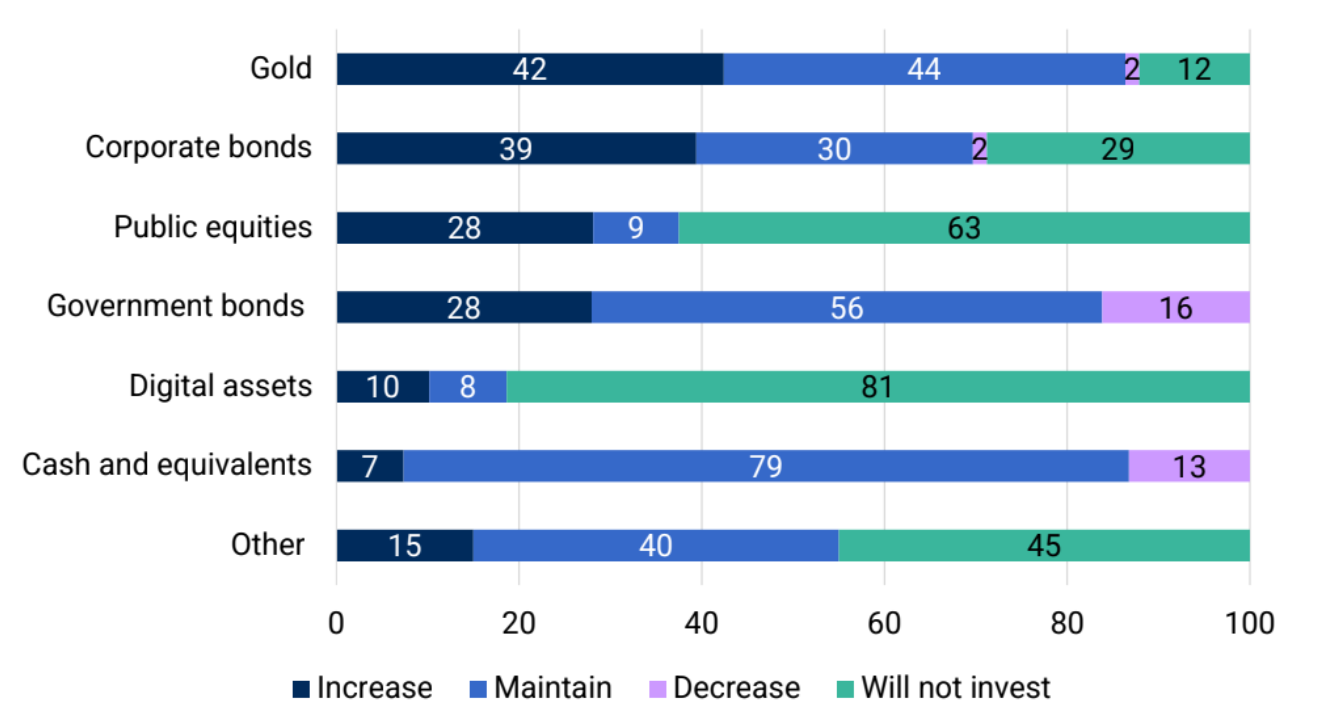

The survey also reveals a clear appetite among many central banks to diversify away from traditional government bonds over the long term. “After gold, corporate bonds and public equities are the asset classes in highest demand over the next decade,” the report notes, with a net demand of more than 25% among respondents looking to increase exposure. Some 16% expect to reduce government bond holdings, and 13% plan to lower cash allocations.

Digital assets are beginning to attract some attention, too, with around 10% of respondents considering increasing allocations. However, the focus is mainly on tokenized securities rather than outright cryptocurrencies. The GPI highlights that only “3% of survey respondents foresee building a strategic Bitcoin reserve.”

“Aside from volatility, geopolitical and regulatory pressures also play a role,” Young said, adding that many central banks “are closely aligned with frameworks like the Basel Accords or IMF guidelines, both which do not yet classify Bitcoin as a reserve-grade asset.”

Seize and hold

Blockchain forensic firm Chainalysis noted in a May report that governments have become some of the largest holders of cryptocurrency, primarily through seizures connected to law enforcement actions. Historically, seized crypto was quickly liquidated through auctions or private sales to recover value for victims or treasury accounts.

This practice appears to be changing now. The United States, for instance, has begun to formalize an approach that moves from automatic liquidation to strategic retention of seized digital assets.

China, which reportedly holds an estimated $50 billion in seized crypto, has a more fragmented system where provincial authorities manage holdings independently, sometimes leading to opacity and concerns over lost long-term value. Analysts say a coordinated national policy could signal a meaningful evolution in China’s stance on digital assets.

However, Chainalysis pointed out that most government agencies “are not yet equipped to actively manage or secure volatile digital assets,” so debate continues on whether to hold or sell.

Early adopters

Some countries have already embraced Bitcoin reserves more boldly. El Salvador’s 2021 move to make Bitcoin legal tender put it in the global spotlight, though this approach has sparked controversy and raised concerns with the IMF. The organization has tied loan conditions to reducing or eliminating Bitcoin policies, illustrating the political risks involved in adopting crypto at the sovereign level. Eventually, El Salvador had to change its regulatory stance on BTC.

“El Salvador’s approach uses Bitcoin as legal tender and a reserve asset to attract investment, tourism, and tech infrastructure,” said Young.

“Their dollarized economy allows flexibility to experiment with Bitcoin as a parallel store of value, although the impact on long-term fiscal stability is still under global scrutiny.”

Shawn Young

Meanwhile, Bhutan offers a quieter but arguably more strategic example. The Himalayan nation mines BTC using renewable hydropower through its sovereign investment fund, turning energy resources into a digital reserve. This approach allows accumulation of Bitcoin without purchasing on open markets or triggering external scrutiny.

“Bhutan’s approach allows for a low-key, infrastructure-first access to Bitcoin,” Young explained, adding that “it proves that resource-rich countries have the ability to convert domestic advantages into digital assets without overhauling monetary policy.”

While Europe’s approach remains cautious, signs of change are emerging. In the Czech Republic, new central bank governor Aleš Michl has proposed allocating as much as 5% of the country’s reserves to Bitcoin.

This stance contrasts with the European Central Bank, where President Christine Lagarde continues to dismiss crypto as unsuitable for reserves, citing liquidity, safety, and anti-money laundering concerns.

Switzerland and Sweden probe Bitcoin’s place in reserves

Switzerland presents a unique case where popular politics may influence central bank policy. A People’s Initiative launched at the end of 2024 proposes amending the constitution to require the Swiss National Bank to hold bitcoin alongside gold. The campaign argues that including bitcoin would “strengthen national sovereignty and future-proof its monetary base.”

Because the SNB is a joint-stock company with strong legal independence, this initiative would require a constitutional amendment and a national referendum, potentially the world’s first on Bitcoin as a reserve asset. While the SNB itself remains cautious, the popular movement signals rising institutional and public comfort with digital assets in a country known for financial privacy and asset protection.

Sweden, meanwhile, has taken a more procedural approach. A parliamentary inquiry has been submitted to the Riksbank on whether BTC should form part of its currency reserves. This inquiry follows the EU’s MiCA regulations, which provide clearer legal frameworks for digital assets. Still, the Riksbank’s mandate prioritizes price stability and risk minimization, making rapid adoption unlikely.