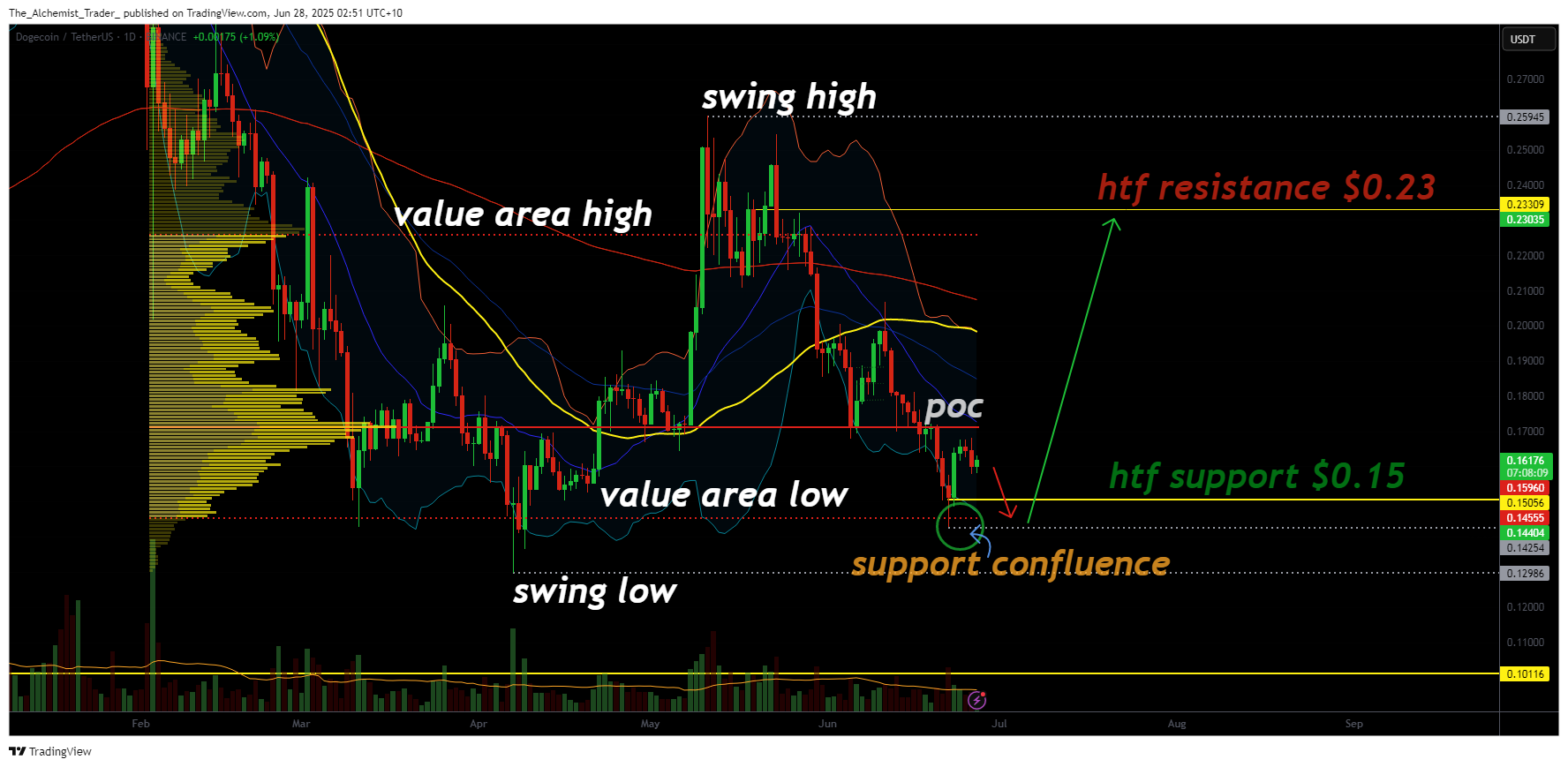

Dogecoin is trading within a tight volume-defined range between support at $0.15 and resistance at $0.23. With volume still below average, a confirmed breakout requires stronger buyer engagement.

Following a corrective move from recent highs, Dogecoin (DOGE) has stabilized within a key trading range. Price action is now compressing between the value area low, which aligns with high timeframe support at $0.15—and overhead resistance at the point of control. This structure suggests DOGE may be forming a bottoming base that could fuel the next leg higher.

Key technical points

- Strong Support at $0.15: Value area low aligns with HTF support and a key swing low.

- Resistance at POC: The point of control is capping price for now, requiring a reclaim to shift structure.

- Volume Remains Below Average: No breakout likely until volume influx supports price expansion.

DOGE is currently navigating a volume-defined trading range, oscillating between the value area low and value area high, with price now sitting near the lower boundary of this range. The $0.15 support level has held firm, acting as both a structural pivot and psychological zone, reinforced by the proximity of a key swing low.

While price has rejected from the point of control, a region with the most traded volume, there is no significant follow-through to the downside. This supports the idea that DOGE is in accumulation rather than breakdown.

The lack of volume, however, is notable. Any confirmed reversal or breakout will require a visible volume influx, something that has been absent over the past several weeks. Without this, price action is likely to continue consolidating within the current range.

A proper bottoming structure is still in development. If DOGE can continue holding above $0.15 while compressing beneath resistance, a reclaim of the POC would be a key early signal of strength. If price can establish multiple closes above the POC, the door opens to an impulsive move back toward the $0.23 resistance zone, and potentially the swing high, provided volume and momentum align.

Until that occurs, the most likely scenario is continued sideways movement with a slight bullish bias, especially given the support confluence at $0.15.

What to expect in the coming price action

Dogecoin is consolidating near key support with decreasing volatility. As long as $0.15 holds, a reclaim of the point of control could initiate a rotation toward $0.23. Traders should watch closely for volume spikes and structural reclaim signals before anticipating directional breakout momentum.