Crypto funds witnessed a second straight week of outflows, totaling $1.17 billion, offset by mild inflows from other regions.

The most significant sell-off was in U.S. products, which accounted for $1.22 billion-worth of exits.

Summary

- Crypto investment products saw $1.17 billion in outflows, marking a second straight week of redemptions led by U.S. funds.

- Bitcoin and Ethereum bore the brunt with $932 million and $438 million withdrawn, while short Bitcoin ETPs gained $11.8 million.

- Altcoins defied the sell-off as Solana attracted $118 million in inflows, with HBAR and Hyperliquid also posting gains.

On Nov. 10, CoinShares Head of Research James Butterfill reported that the outflows were heavily concentrated in the two largest crypto assets, with Bitcoin (BTC) seeing $932 million redeemed and Ethereum (ETH) facing a $438 million exit.

The report noted that this negative sentiment was compounded by political uncertainty, as a brief intraday rebound on hopes of a U.S. government shutdown resolution was swiftly erased by Friday’s outflows.

“ETP Trading volumes remained elevated at US$43bn for the week as flows on an intraday basis briefly recovered on Thursday as optimism grew that progress was being made toward resolving the US government shutdown, but this proved short-lived, with renewed outflows emerging on Friday as those hopes faded,” Butterfill said in the report.

Short bets climb, altcoins defy the exodus

Beneath the broad sell-off, nuanced investor strategies emerged. While long Bitcoin products were hammered, short Bitcoin ETPs attracted $11.8 million in inflows. According to Butterfill, this marks the highest weekly inflow for bearish Bitcoin bets since May, indicating a segment of the market is actively positioning for further downside.

This defensive posture, however, was not universal. Altcoins presented a striking counter-narrative. Solana (SOL) continued its remarkable run, pulling in $118 million last week and bringing its nine-week total to a staggering $2.1 billion.

Other assets — Hedera (HBAR) and Hyperliquid (HYPE) — also defied the trend, registering inflows of $26.8 million and $4.2 million, respectively.

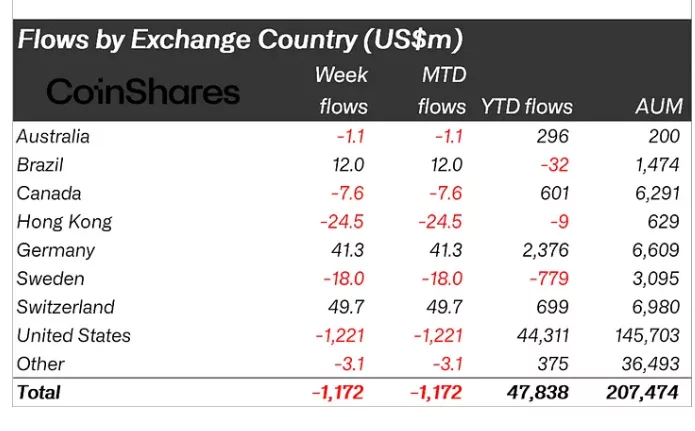

European investors displayed a markedly different conviction than the U.S. Germany and Switzerland saw inflows of $41.3 million and $49.7 million, respectively, continuing a pattern of transatlantic divergence.

Compared with the prior week’s $360 million total outflows, when Bitcoin alone shed $946 million, this week’s $1.17 billion bleed confirms that redemptions are deepening rather than dispersing.

The persistence of heavy U.S. selling, combined with contrasting European inflows, paints a picture of two markets responding to the same macro environment through opposite lenses. One remains risk-averse and policy-dependent; the other, quietly opportunistic.