Popular Bitcoin mining stocks have formed the rare death cross pattern, pointing to more pain ahead.

CleanSpark and Marathon Digital have formed a death cross

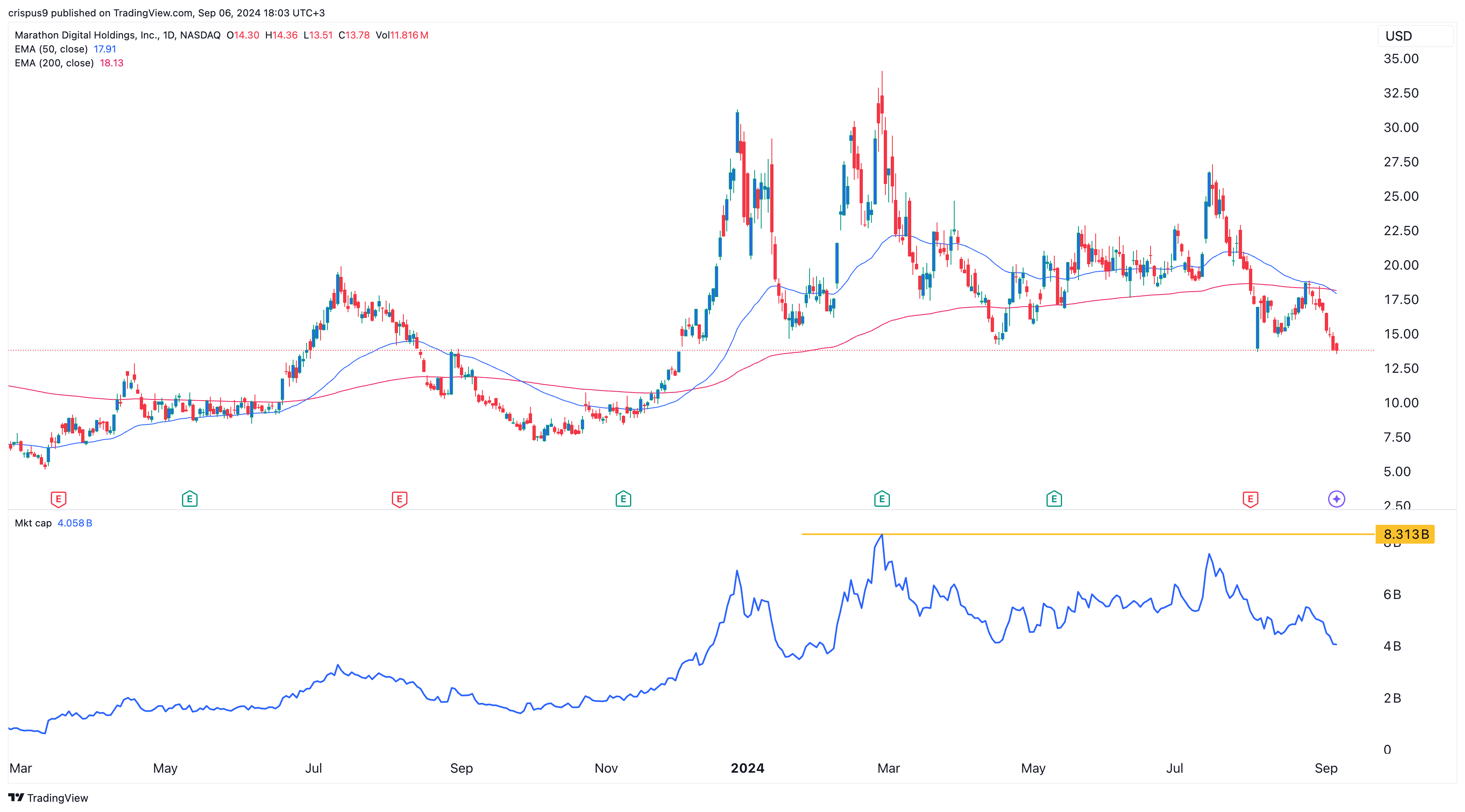

Marathon Digital, the largest mining company in the industry, dropped to $13.75 on Sep. 6, its lowest swing since December of last year. It has fallen by 60% from its highest point this year, erasing over $4 billion in value.

Similarly, CleanSpark shares crashed to $8.39, the lowest point since February, and are 66% below their highest level this year. Its market cap dropped from $5 billion in March to $2 billion.

Other Bitcoin (BTC) mining stocks, such as Riot Platforms, Core Scientific, Cipher Mining, and Argo Blockchain, have also continued to fall.

Most notably, Marathon Digital and CleanSpark have formed a death cross pattern, where the 200-day and 50-day moving averages have crossed each other. In most periods, this pattern leads to more downside.

A notable example of this is Riot Platforms, which formed a death cross on April 9. Since then, the stock has dropped by 40% and is hovering at its lowest point since March 2023, making it one of the worst-performing mining stocks this year.

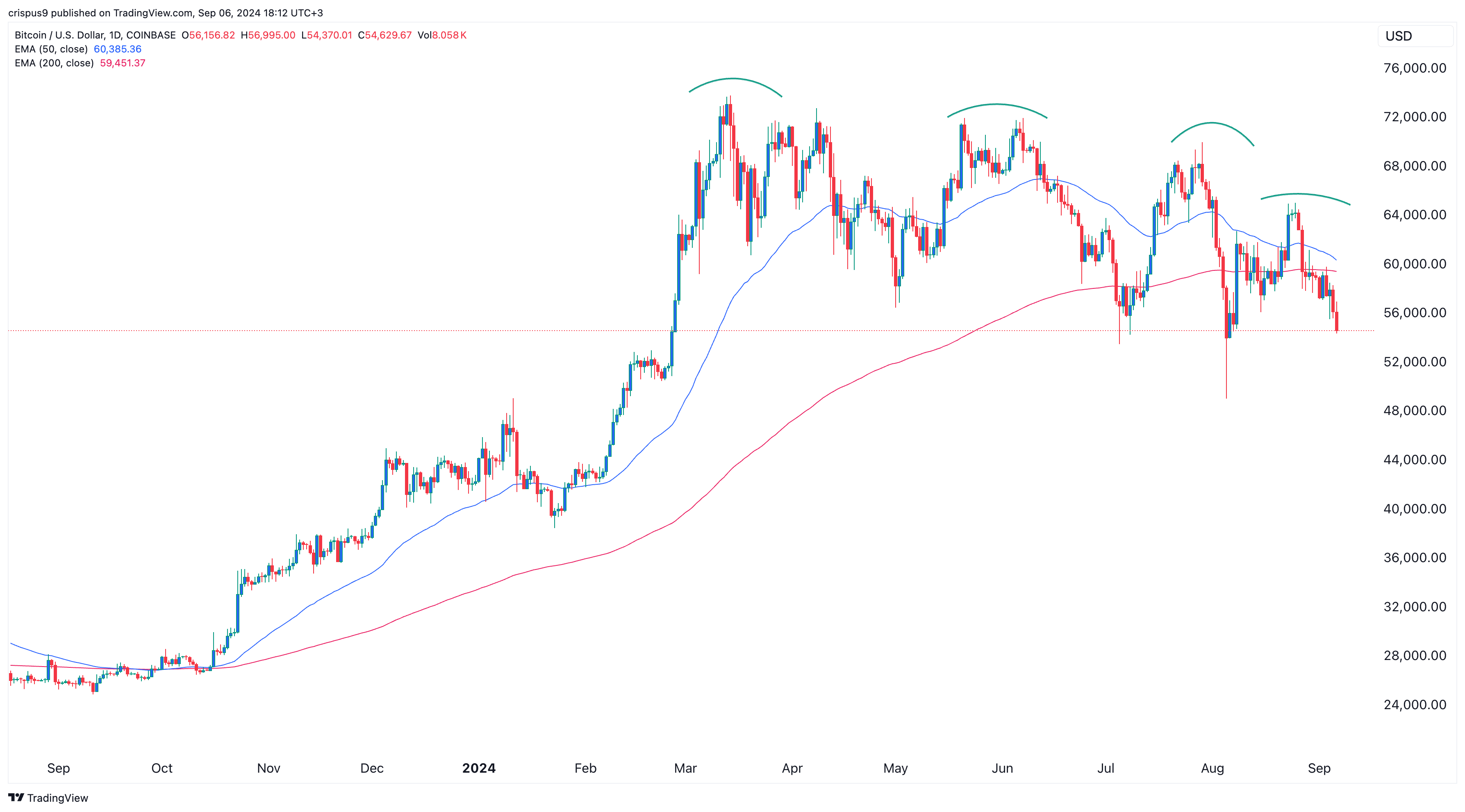

Bitcoin is also nearing a death cross

These mining stocks are crashing due to a combination of two factors: low Bitcoin prices and weak production.

Bitcoin dropped below $55,000, reaching its lowest point since Aug. 7. It has fallen by 25% from its highest point this year and by 15% from its August high.

Bitcoin’s sell-off may continue as it has formed a series of lower lows and lower highs. It is also close to forming a death cross, indicating that bears have taken control. A drop below last month’s low of $49,000 could signal further downside.

Bitcoin mining companies are also producing fewer coins than they did in August because of the halving event. Marathon Digital produced 673 coins in August, down from 692 in July and 850 in April.

Similarly, CleanSpark produced 478 coins in August after producing 721 in April while Riot Platforms mined 322 coins in August from the previous month. Other mining companies have seen a similar drop in production.

Therefore, a combination of lower Bitcoin prices and weak production suggests that their revenue will continue to decline, while the mark-to-market value of their holdings will also drop. Marathon Digital, Riot Platforms, and CleanSpark hold 25,000, 9,334, and 7,052 coins on their balance sheets.

From: crypto.news

Crypto News