Chainlink price sold off over the past few days, mirroring the performance of Bitcoin and other altcoins.

Chainlink (LINK) dropped to $13.70 on Monday, its lowest point since May 8 and 23.75% below its May high. Despite this correction, here are three key reasons why LINK may rebound this month.

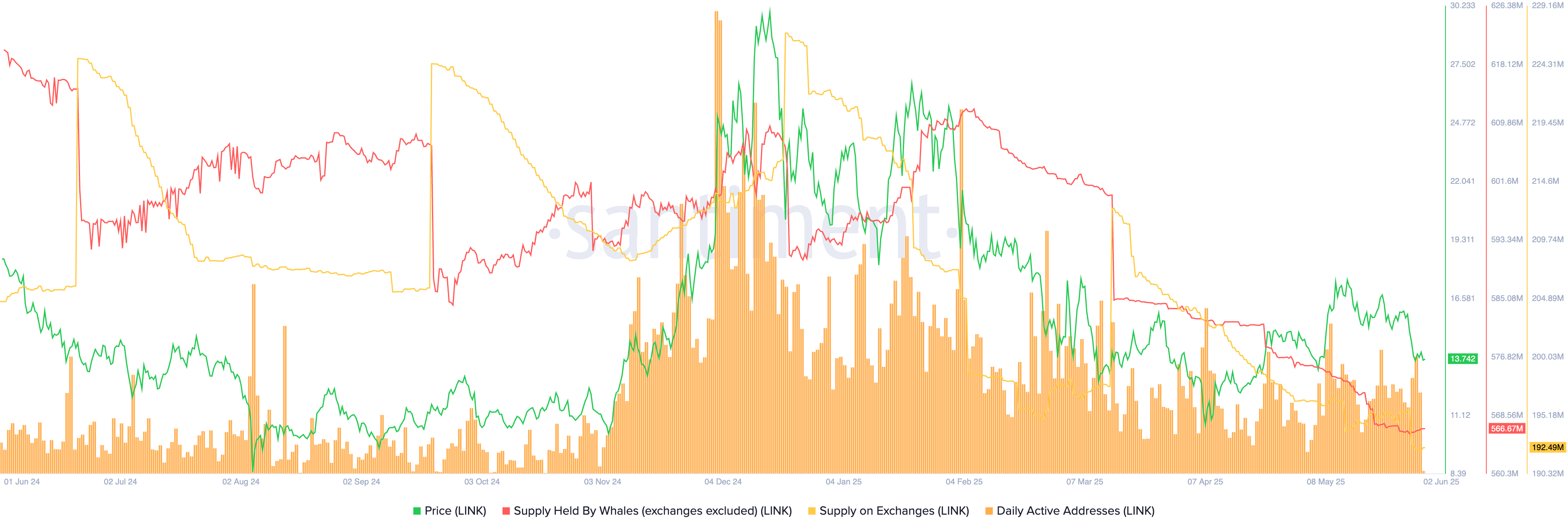

A key bullish catalyst is the decline in LINK supply held on centralized exchanges, as investors move tokens into self-custody wallets. According to Santiment data, there are now 192 million LINK tokens on exchanges, down from 226 million in November 2023.

This decrease signals growing investor confidence in Chainlink’s long-term recovery potential.

That optimism is backed by Chainlink’s strong fundamentals. The project has secured partnerships with high-profile institutions such as JPMorgan, ANZ Bank, UBS, Coinbase, Solv Protocol, and Swift.

These companies are exploring how to integrate Chainlink’s technology into the real-world asset tokenization space. Chainlink’s Cross-Chain Interoperability Protocol has emerged as a leading infrastructure tool, enabling seamless communication between different blockchains.

Chainlink also dominates the decentralized oracle space, securing over $43 billion in assets across DeFi protocols. Its closest competitor, Chronicle, secures $7.4 billion in total value.

Whale selling has eased

Another positive signal for LINK is that whale selling has slowed in recent days. Whale-held supply stands at 566.67 million tokens, up from 565.9 million last week.

If accumulation continues, it would mark the end of the selling trend seen since March, when whale holdings peaked at nearly 612 million coins. Renewed whale accumulation would serve as a strong bullish signal.

In parallel, Chainlink network activity is increasing. The number of daily active addresses has risen, further supporting the bullish case.

Chainlink price harmonic pattern

Technically, LINK may be setting up for a major breakout based on a harmonic pattern forming on the weekly chart. The XABCD formation—a widely followed bullish continuation pattern, appears to be in play.

- The XA leg unfolded between March 2024 and July 2023.

- The AB correction followed between July and November.

- The BC leg extended from November to April 2025.

If the pattern completes, the CD leg is now underway, potentially pushing LINK to its November high of $30.92, representing a 125% gain from current levels.