Bitcoin price is stabilizing after a sharp correction, but on-chain data suggests the real story may lie beneath the surface.

Summary

- Bitcoin consolidates near $68,000 after falling from the mid-$90,000s to $60,000, with the 50-day SMA around $83,000 acting as key resistance.

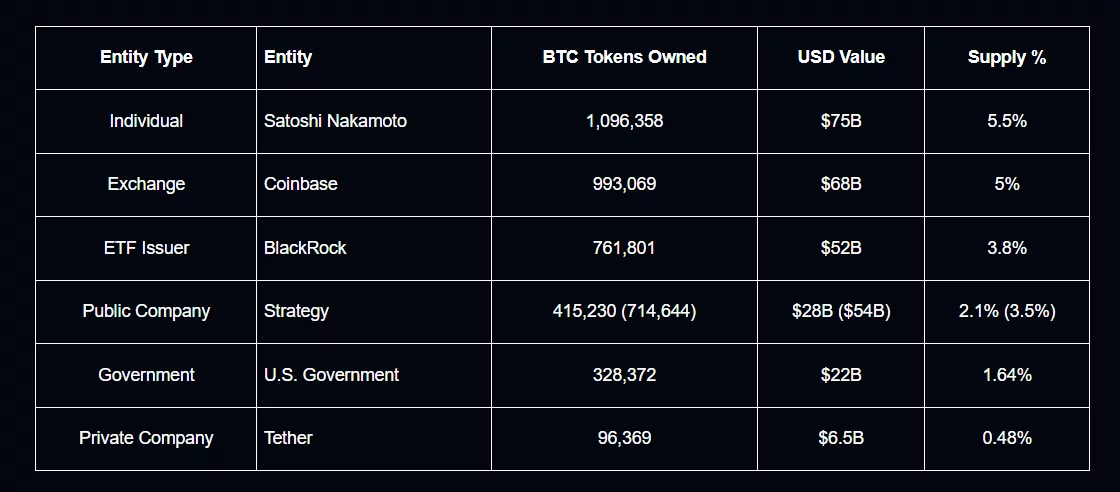

- Arkham data shows heavy supply concentration, with Satoshi, major exchanges, BlackRock’s ETF, Strategy, and the U.S. government controlling a significant share of total BTC.

- Whale inactivity and potential exchange outflows could tighten supply, meaning renewed institutional demand may trigger a sharper upside move.

As Bitcoin (BTC) consolidates near the $68,000 level, Arkham Intelligence’s latest ownership data reveals who controls a large share of supply and that concentration could shape the next breakout or breakdown.

Bitcoin price recently fell from the mid-$90,000 region earlier this year to a local low near $60,000 before rebounding. At press time, price action shows consolidation below the 50-day simple moving average, which sits around $83,000. That level now acts as dynamic resistance.

Until bulls reclaim it, upside momentum remains capped.

The daily chart shows heavy selling through late January and early February. A sharp capitulation candle drove price toward $60,000, followed by a reflex bounce.

However, the Chaikin Money Flow indicator remains slightly negative at around -0.03. This suggests capital inflows are still weak. Momentum has improved, but conviction is not yet strong.

While short-term momentum remains fragile, ownership structure tells a longer-term story.

Bitcoin whale concentration and supply control

Arkham’s 2026 data shows Bitcoin ownership remains highly concentrated. Satoshi Nakamoto’s wallets still hold roughly 1.096 million BTC, representing over 5% of total supply.

Coinbase controls close to 1 million BTC, while Binance holds more than 600,000 BTC. BlackRock’s spot ETF alone holds over 760,000 BTC. Strategy, formerly MicroStrategy, controls more than 400,000 BTC. The U.S. government also holds over 300,000 BTC.

This concentration matters. Large holders reduce effective circulating supply when coins remain dormant. Satoshi’s coins have never moved. Corporate and ETF holdings also tend to be long-term allocations rather than short-term trading inventory. That structurally tightens supply during periods of demand expansion.

However, exchange balances are a different story. When large exchanges hold significant BTC reserves, liquidity remains accessible. If exchange-held Bitcoin begins declining while ETFs continue accumulating, the float could tighten quickly. In that scenario, even modest demand could trigger an outsized upside move.

What it means for Bitcoin price’s next move

Technically, Bitcoin must reclaim the 50-day SMA near $83,000 to confirm a bullish reversal. A break above that level could open a move back toward $90,000. Failure to hold $65,000 may expose $60,000 again.

Structurally, whale dominance suggests long-term supply remains constrained. If institutional demand returns while major holders stay inactive, price pressure could build quickly.

The next decisive move will likely depend on whether capital inflows return and whether the biggest holders continue to sit tight.