Bitcoin’s supply on exchanges has fallen to its lowest level, raising expectations for a potential spike in volatility.

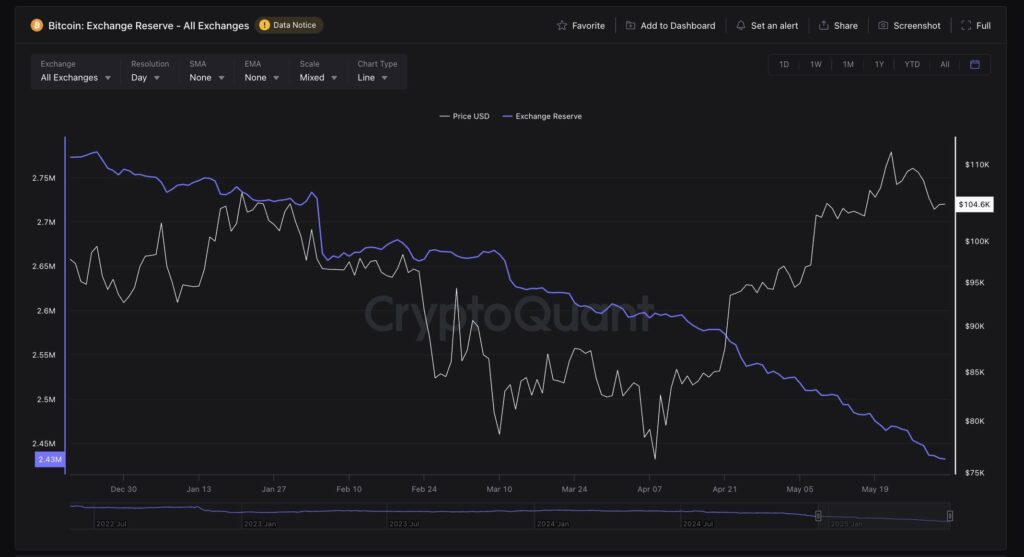

According to data from CryptoQuant, the total amount of Bitcoin (BTC) held across all centralized exchanges decreased to just under 2.5 million BTC as of late May 2025. This steady drop has been accompanied by a strong price rally, with Bitcoin most recently reaching a new all-time high above $111,500.

The data indicates a significant divergence between exchange reserves and prices. While the quantity of Bitcoin held on exchanges has been declining, its value has increased. On the CryptoQuant chart, this is illustrated by a white line moving upward for price, and a blue line sloping downward for reserves.

Historically, a declining supply of Bitcoin on exchanges has driven up prices, particularly when demand is high. This is seen by many analysts as an indication that the market may be about to enter a new phase, where sharper moves in either direction are fueled by limited supply.

Institutional accumulation appears to be playing a major role in the current market structure. Large holders, including wallets with between 1,000 and 10,000 BTC, have been steadily accumulating, with much of the BTC being sent to cold storage.

Strategy added 7,390 BTC in May, bringing its total holdings to 576,230 BTC, roughly 2.75% of total supply, acquired at an average price of $69,726. Other public companies, including GameStop and Japan-based Metaplanet, have also been actively adding to their holdings.

Meanwhile, spot Bitcoin exchange-traded funds brought in $5.23 billion in inflows over the past month, according to SoSoValue data. Several governments are following suit. The UAE and Pakistan have stepped up their accumulation efforts, while U.S. lawmakers are discussing the creation of a national Bitcoin reserve.

From a technical perspective, Bitcoin appears to be in a wait-and-see phase. Momentum indicators are mixed. The relative strength index stands at 52, showing neutral momentum, while the moving average convergence divergenc has turned slightly bearish. Short-term moving averages indicate some downward pressure but the longer-term outlook remains intact.

Bitcoin is trading well above the 200-day EMA and SMA, which are both on an upward trend. The rally may continue toward $110,000 or higher if Bitcoin is able to recover its short-term moving average of around $106,000. However, a decline toward $98,000 or even $94,000 is possible if it is unable to maintain support.