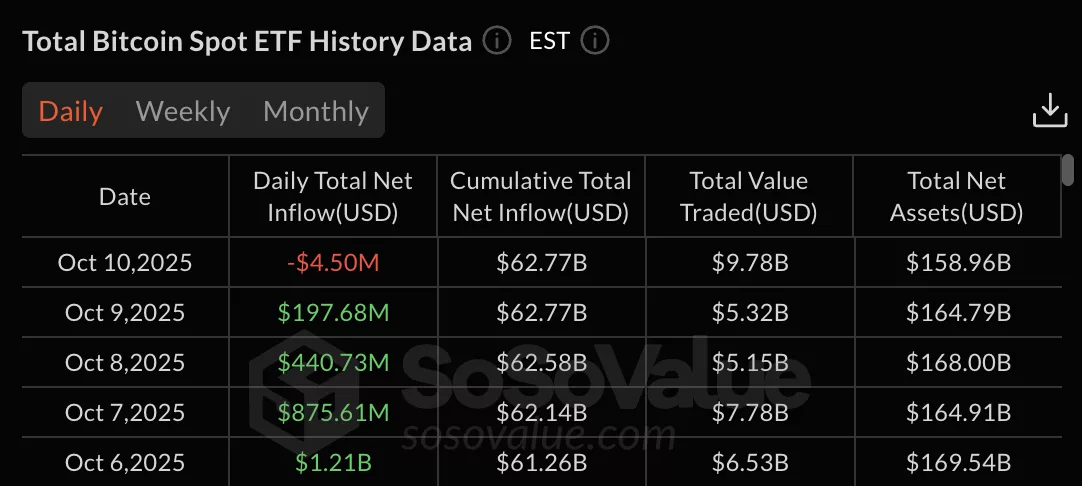

Bitcoin ETFs recorded $4.50 million in net outflows on Friday, Oct. 10, ending a nine-day streak of positive flows that had brought over $5 billion into the products.

Summary

- Bitcoin ETFs saw $4.5 million in net outflows on Oct. 10, ending a nine-day streak of positive inflows totaling over $5 billion. The reversal coincided with an 8% drop in Bitcoin’s price.

- Cumulative net inflows across all Bitcoin ETFs remain strong at $62.77 billion, with total assets at $158.96 billion. BlackRock’s IBIT bucked the trend (+$74.21M); Bitwise’s BITB (-$37.45M); Grayscale’s GBTC (-$19.21M); and Fidelity’s FBTC (-$10.18M).

- The outflows mark the first negative day since Oct. 1, when ETFs began a sustained inflow period highlighted by $1.21 billion on Oct. 6 and $875.61 million on Oct. 7. ETF data suggest growing institutional caution despite price stabilization.

The reversal comes as Bitcoin (BTC) price slumped 8% in the last 24 hours, falling from a 24-hour high of $122,000 to as low as $105,000 before recovering to $111,700.

Cumulative total net inflows remain at $62.77 billion across all Bitcoin ETF products, with total net assets standing at $158.96 billion.

The outflows mark the first negative day since the streak began on Oct. 1, when ETFs attracted $675.81 million.

This was followed by major inflow days, including Oct. 6, with $1.21 billion, and Oct. 7, with $875.61 million.

Mixed performance across individual Bitcoin ETFs

The Friday outflows were not uniform across providers, with BlackRock’s IBIT managing to attract $74.21 million in inflows while several other products experienced redemptions.

Fidelity’s FBTC saw $10.18 million in outflows, Grayscale’s GBTC recorded $19.21 million in redemptions, and Grayscale’s BTC product lost $5.68 million.

Ark 21Shares’ ARKB experienced $6.21 million in outflows, while Bitwise’s BITB saw the largest single-day redemption at $37.45 million.

Multiple products, including VanEck’s HODL, Invesco’s BTCO, and several others, reported zero net flows for the day.

The previous day, Oct. 9, had seen $197.68 million in inflows, maintaining the positive momentum that was seen in most of the month.

The sharp 8% decline in Bitcoin’s price from $122,000 to $105,000 appears to have triggered profit-taking among institutional investors who had accumulated positions during the nine-day inflow streak.

Bitcoin’s recovery to $111,700 suggests the selloff found support at lower levels. However, the ETF outflows indicate institutional caution regarding the near-term price direction.