The crypto mining firm Bit Digital officially marks its departure from Bitcoin mining and towards Ethereum staking by issuing $150m shares in a public offering to buy more ETH.

In a recent press release, Bit Digital announced that it will be issuing 75 million shares at $2 each, with an additional 11.25 million shares available to underwriters via a 30-day option. In total, the public offering will be enough to raise $150 million in capital.

The offering is set to close on June 27 and will be subjected to “satisfaction of customary closing conditions.”

According to the company’s statement, the funds generated from the public offering will be used to buy Ethereum (ETH) in order to accelerate building an ETH treasury. The company describes itself as a “digital asset platform focused on Ethereum-native treasury and staking strategies.”

This marks one of the largest public ETH treasury commitments to date. Not only that, it also marks the company’s first major pivot from Bitcoin (BTC) mining as it attempts to fully transition towards Ethereum staking and building a dedicated ETH treasury.

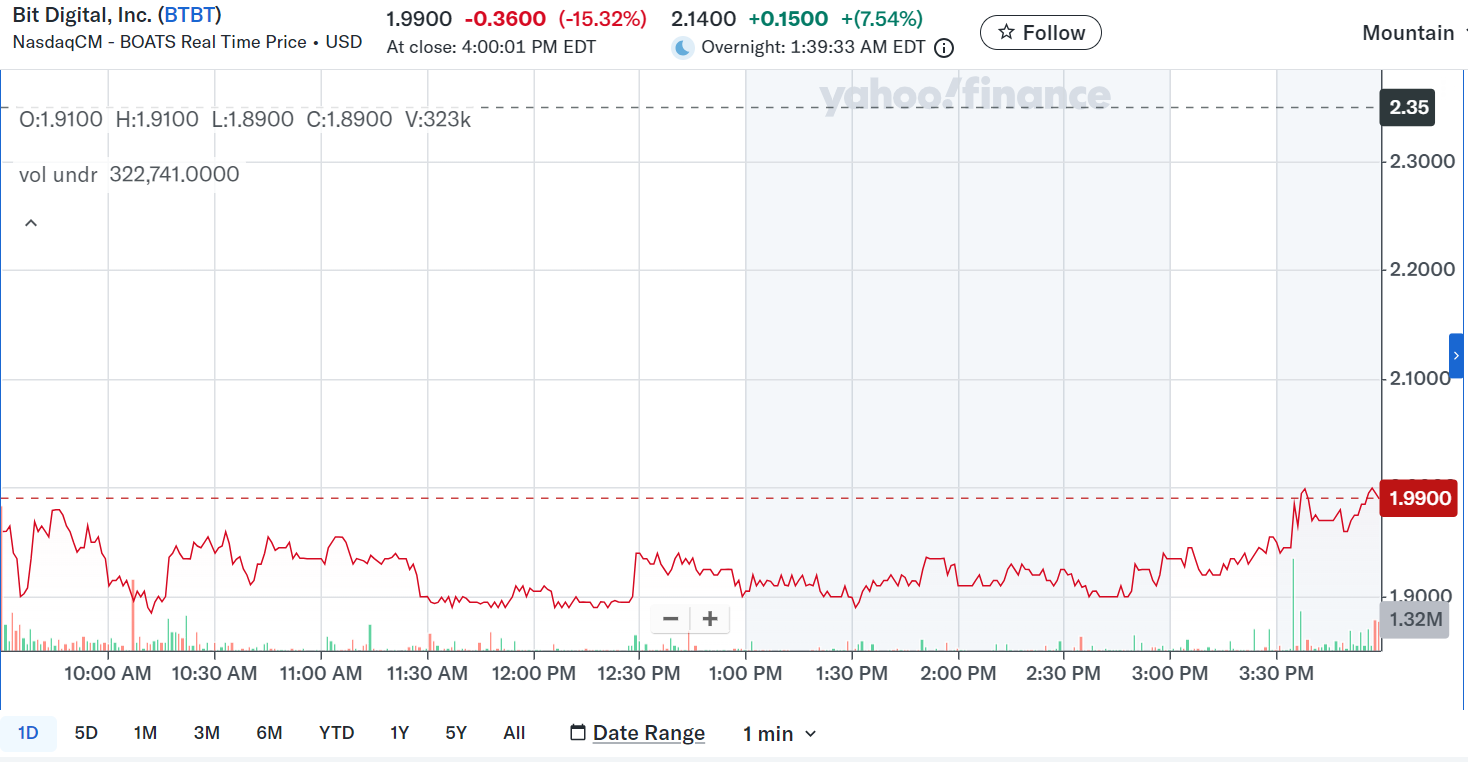

After the news broke, indicating that it would be formally ditching Bitcoin in favor of Ethereum, the Bit Digital stock BTBT plummeted by 15.32% upon the latest closing price. The BTBT stock is currently valued at $1.99 in the market, according to Yahoo Finance.

Despite this fact, the firm has started accumulating ETH alongside its Bitcoin holdings since 2022. As of June 14, Bit Digital held approximately 24,434 ETH (nearly $59.6 million) and 417.6 BTC ($44.85 million). With the recent public offering, the company will be able to increase its Ethereum holdings to $209.6 million based on the current value of ETH, which sits at $2,441.

The company declared that it plans to convert all its Bitcoin holdings into Ethereum in the future.

Earlier this month, amidst the rapidly growing trend of institutions vying for BTC reserves, companies focused on building corporate Ethereum reserves are also catching up. As previously reported by crypto.news, on June 19 strategic reserves among institutions amounted to 1.190 million ETH.

The 1.190 million ETH now held by corporations amount to more than 1% of the total supply of ETH or worth nearly $3 billion at current market prices.