Binance has just recorded its highest stablecoin inflow throughout 2025, seeing a record high of as much as $6.2 billion flowing into the exchange on September 8 alone. What could it mean?

Summary

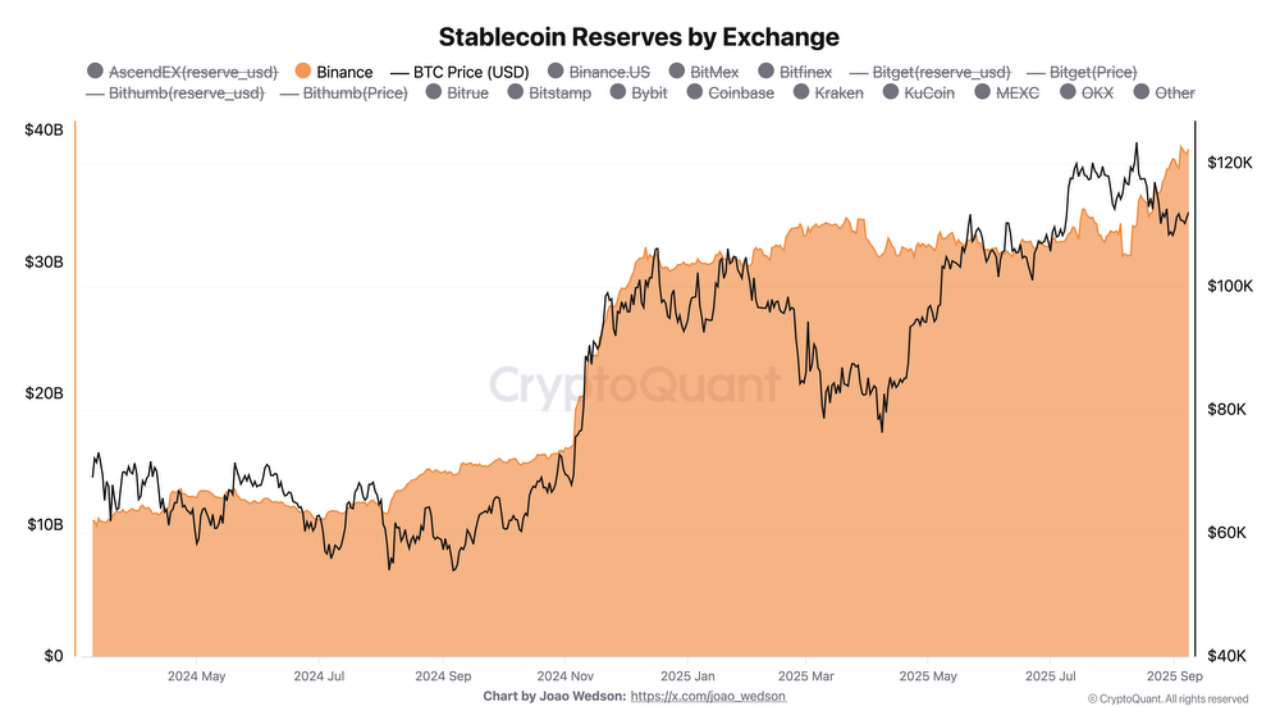

- Binance stablecoin reserves have reached a new record high at $39 billion, following a significant surge.

- A boost in stablecoin reserves could reflect the market bracing itself for the FOMC meeting.

According to the analysis by CryptoQuant expert Darkfost, the boost in stablecoin inflow has pushed Binance’s stablecoin reserves to a new all-time high. With the addition of $6.2 billion, its net stablecoin inflows have reached at least $39 billion; nearing the $40 billion threshold.

This stablecoin hype wave comes just a week before the highly anticipated Federal Open Market Committee or FOMC meeting that is scheduled for Sept. 16 to Sept. 17. The surge in stablecoin deposits could mean that traders are moving more of their funds onto exchanges, preparing to deploy them into assets like Bitcoin (BTC), Ethereum (ETH) or other altcoins.

“While BTC remains in a corrective phase that has lasted for a month, market expectations are now pricing in a 100% probability of a rate cut at the next FOMC meeting,” said Darkfost in a recent analysis.

Moreover, Darkfost also noted that the growth of reserves on exchanges like Binance tend to move in parallel to Bitcoin price action. This is indicated by the chart that was shared by the analyst, which shows BTC moving in similar patterns to the exchange’s stablecoin reserves marked in color.

What Binance’s stablecoin reserves mean for the market

The rise in stablecoin deposits could become an indication of market trends, as traders brace themselves for whatever decision the Federal Reserve will make regarding interest rates. According to Darkfost, the increase in stablecoin inflows signal Binance preparing to meet exchange user needs.

On the other hand, the analyst said it could also reflect an increase in stablecoin transfers onto the platform as of late.

“This suggests that liquidity continues to flow into the market, with Binance standing out as a primary entry point,” said Darkfost.

In the crypto market, stablecoins often act as a bridge between fiat and digital assets, giving traders flexibility amidst uncertain macro conditions. Whether the result of the FOMC meeting sparks a rally or a pullback, the surge of stablecoin reserves on exchanges suggests that crypto markets are primed for significant movement, reinforcing the narrative that macro policy remains a core driver of digital asset price action.