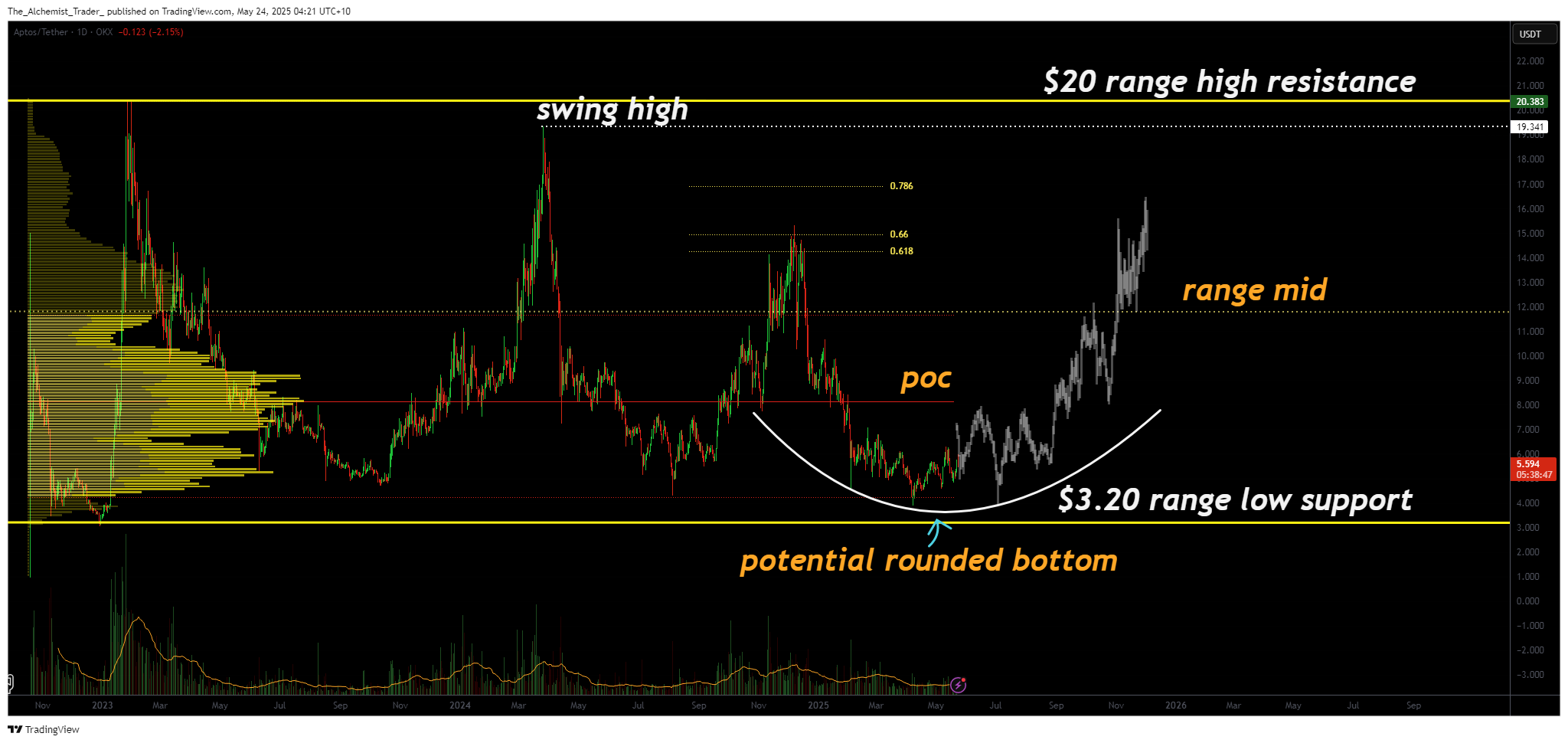

Aptos is holding firm at a key long-term support zone near $3.20, a level that has historically preceded strong bullish reversals. A breakout above resistance could ignite a move toward $20.

Aptos (APT) is trading at the lower boundary of a large high time frame range, a zone that has historically acted as a strong support base. This range low, combined with the value area low, forms a technical confluence around the $3.20 region. Price action has respected this level multiple times since 2022, each time preceding a bullish rally toward the $19–$20 resistance zone.

The current structure suggests accumulation is underway, potentially setting the stage for a rounded bottom formation — a classic reversal setup. However, a break above the point of control (POC) is essential to confirm the start of an expansion phase. Until then, Aptos remains range-bound, but the context leans bullish.

Key technical points,

- Major Support: $3.20 range low in confluence with the value area low

- Key Resistance: Point of Control (POC) needs to be broken with volume

- Target Resistance Zone: $19–$20, the long-term range high

From a structural perspective, Aptos is forming a rounded bottom, which often signals accumulation and the potential for reversal. As price curls up from the support zone, momentum is gradually building. The most critical level to monitor now is the point of control — a horizontal level of heavy volume that has historically acted as a ceiling for price.

A convincing breakout above the POC, backed by a spike in volume, would shift the current structure from consolidation into expansion. Historically, price has accelerated toward the $20 region shortly after breaking above this level. This same setup could be unfolding again, and as long as price holds the current $3.20 support, the probability of upside continuation increases.

Market context also shows that Aptos is trading within a clearly defined range, but with each touch of the lower boundary, bullish responses have followed. The pattern suggests that the current phase is more likely an accumulation rather than distribution, increasing the odds that the next major move will be to the upside.

What to expect in the coming price action

If Aptos continues to hold the $3.20 level and breaks above the point of control with volume, a move toward the $19–$20 range high is likely. Until then, expect consolidation with a bullish bias as accumulation continues beneath resistance.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.