Ripple, the cross-border payment giant, hit key milestones with the SEC lawsuit settlement appeal, stablecoin partnerships, and ecosystem growth. XRPLedger’s native token XRP rallied alongside, catalyzed by bullish developments. In nearly two weeks, whales boosted their XRP holdings, shocking traders.

XRP is trading above $2, over 33% above its April 7 low of $1.64. Within two months XRP observed a sharp rally while traders await a drop in Bitcoin (BTC) dominance and an altcoin season.

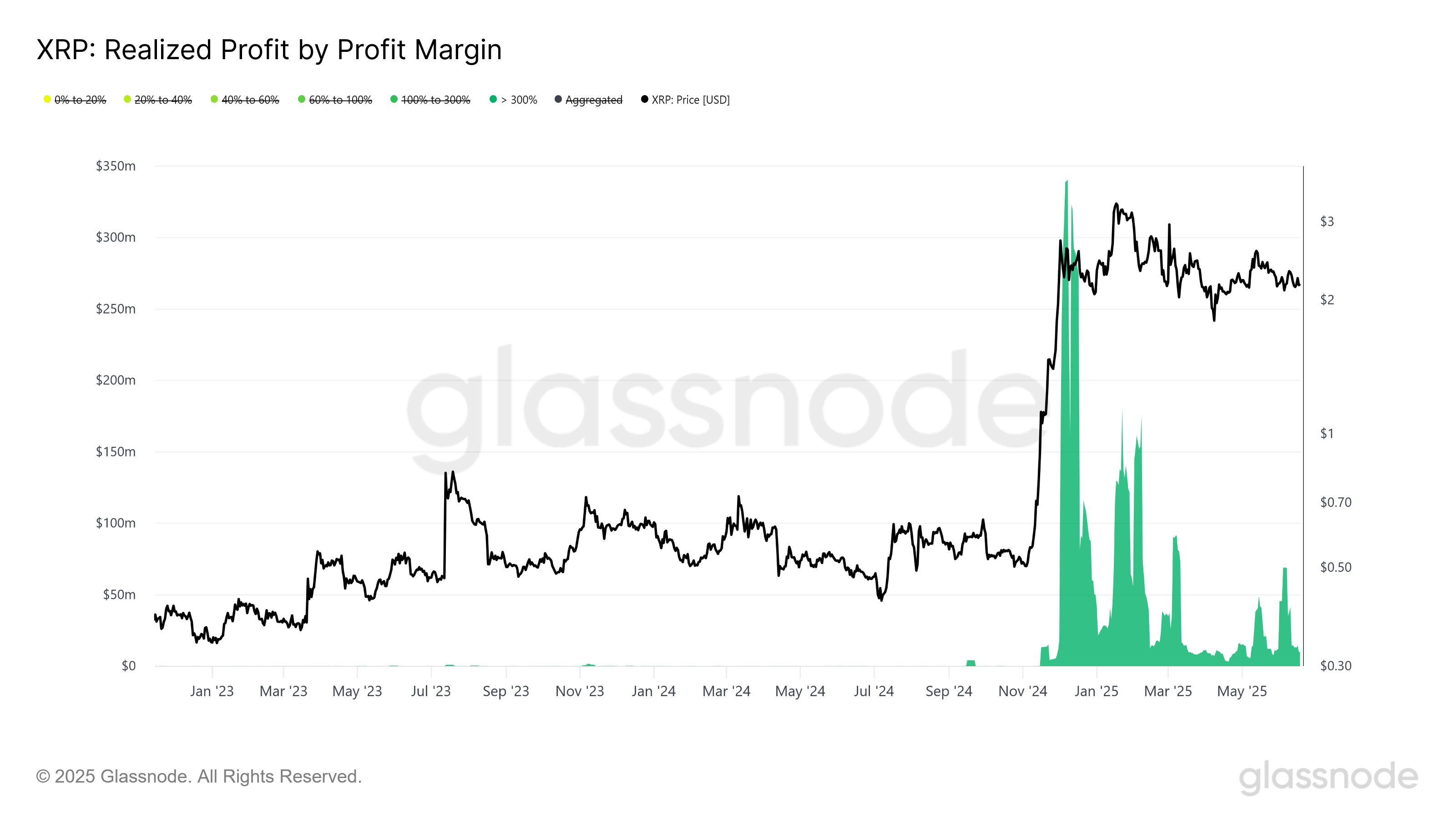

XRP bulls are sitting on over 300% gains

XRP/USDT daily price chart shows that between November 2024 and Friday, June 20, XRP added 335% to its value. XRP traders who acquired the token prior to November 2024 are sitting on over 300% in unrealized gains.

Between April 2025 and the time of writing, XRP rallied nearly 65%, climbing from April low of $1.6134 to the May 2025 peak of $2.6549. XRPLedger’s native token is less than 25% away from the May 2025 peak, trading above key support at $2.

Key resistance levels are $2.2524, $2.6549, and $3, and support levels are $2 and $1.6134. The 2025 peak of $3.4000 is a target for XRP to re-test in Q3 2025.

Technical indicators on the daily timeframe, RSI and MACD show mixed signals. RSI reads 45 and MACD flashes red histogram bars under the neutral line.

If XRP ends consolidation and sees a daily candlestick close above $2.2524, it could test resistance at $2.6549.

In early June, retail traders sitting on unrealized gains began realizing profits at a pace of $68.8 million per day (7D-SMA), and a wave of distribution by early holders was accompanied by whale accumulation.

Whale demand and institutional interest

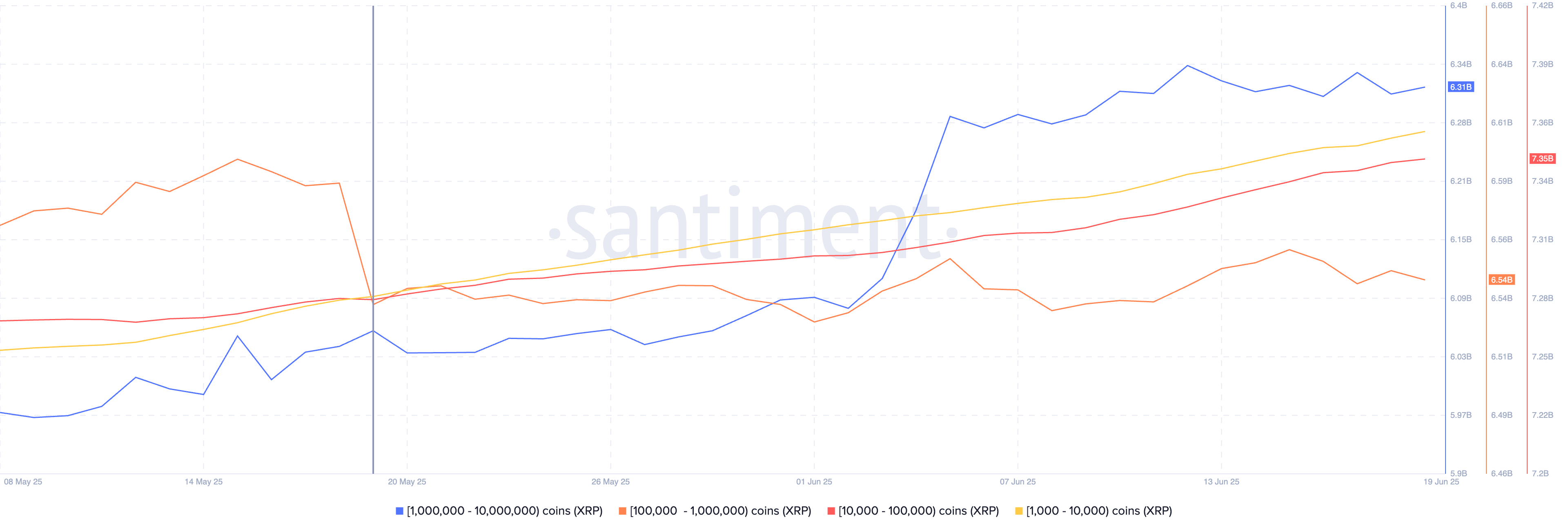

In the past 30 days, XRP whales have accumulated a large volume of the altcoin, as seen on crypto intelligence tracker Santiment. Large wallet investors holding between 1 million and 10 million XRP tokens added 260 million XRP tokens in the past 30 days.

Whale wallets holding between 100,000 and 1 million XRP scooped up 10 million XRP, the lower two categories of whales with 1,000 to 100,000 XRP added over 100 million XRP tokens to their holdings between May 19 and June 19.

Observing the massive accumulation by nearly all whale cohorts, it is clear that large wallet investors have created demand for XRP in the past 30 days, supporting a bullish thesis for the altcoin. Recent geopolitical tensions and US macroeconomic developments could not fade XRP gains in the past month, fueling the bullish narrative further.

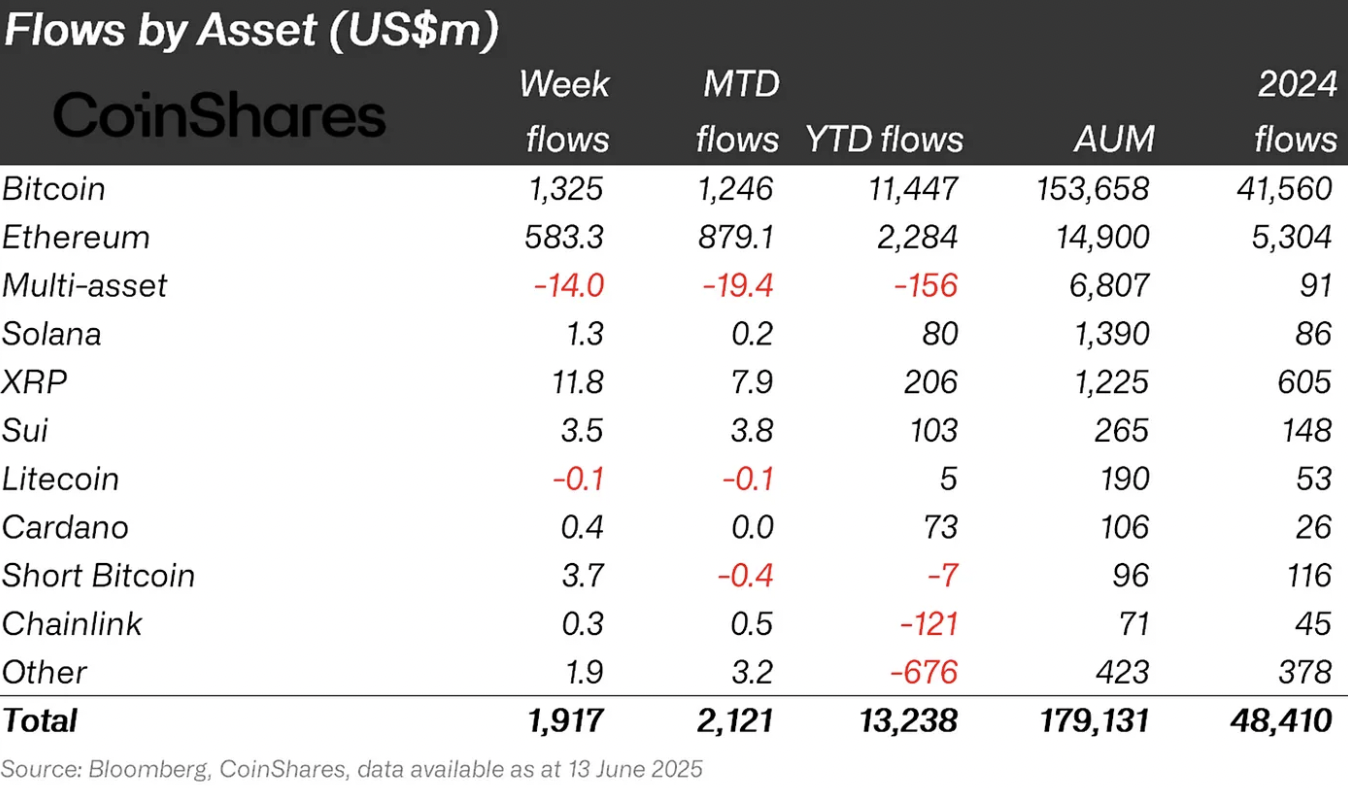

Institutional interest is evident from Digital Asset Fund Flows data compiled by CoinShares in their recent weekly report. XRP funds attracted over $11 million in weekly inflows from institutions last week, second only to Ethereum, the largest altcoin.

Further, XRP funds have seen $206 million in year-to-date flows, the highest among other altcoins like Solana (SOL), Sui (SUI), Cardano (ADA), Litecoin (LTC), Chainlink (LINK) and others.

The news of XRP’s treasury allocation by Chinese mobility startup WeBus International and VivoPower is another notable developments that mark institutional interest in the altcoin.

Ripple fuels demand, catalysts for XRP

Institutional demand is supported by developments at payment remittance firm Ripple. The cross-border payment firm recently urged UK regulators to accelerate crypto regulation through a proposal submitted at the London Policy Summit.

The firm has previously worked with regulators in Dubai, the EU, and Singapore to make strides in crypto regulation. Ripple’s role in crypto regulation is prominent with the SEC’s lawsuit against the firm, which is nearing the end of the appeal process.

The firm’s initiative to push for clearer crypto regulation has fueled a positive sentiment among market participants throughout the market cycle.

Japanese firm SBI Holding’s support for XRPLedger and native token XRP have been listed as the largest single catalyst driving gains in the altcoin, by several notable analysts and community members on X. The firm owns 9% of Ripple Labs equity, acquired in 2016.

Ripple’s partnerships boost the firm’s stablecoin and XRPLedger adoption, building on the use case for native token XRP.

What to expect from XRP after the SEC lawsuit ends?

One of the biggest roadblocks in XRP’s trajectory is the SEC v. Ripple lawsuit, currently in the appeals process. Commenting on the most recent developments in the lawsuit, attorney Bill Morgan says that the SEC’s new approach to crypto regulation has “encouraged Ripple to seek more than it would have been satisfied with or lived with before the SEC filed its appeal.”

If the regulator had not filed an appeal of the summary judgment decision, Ripple would not have filed an appeal on Judge Analisa Torres’ decision on the institutional XRP sales and both parties would have moved on from the lawsuit without a longer process.

The lawsuit is now expected to end somewhere in August 2025 and the effect on XRP will likely be positive. The removal of legal hurdles could further boost Ripple’s partnerships and the demand for the firm’s XRPLedger blockchain, the infrastructure layer for several cross-border payment firms and institutions.

XRP, the native token of the chain, could therefore benefit from a boost in usage and adoption, driving further value and gains in H2 2025.

A return to the 2025 peak of $3.40 is expected once XRP ends consolidation. The altcoin could continue testing levels previously noted in the 2018 bull run and extend gains for holders.

Canada beats US in XRP ETF race, what’s next

While the US has made strides in crypto and stablecoin regulation in the ongoing market cycle, Canada beat the “crypto capital” with the launch of 3iQ XRP ETF. Paul Grewal, an American attorney and Chief Legal Officer at Coinbase noted in a recent tweet that Canada’s Purpose Investments is launching the country’s first XRP ETF on June 18 while the SEC is in the process of accepting/ rejecting XRP ETF applications in the US.

Grewal says his tweet should serve as a reminder that “regulatory clarity drives innovation,” and the US has yet to catch up with its neighbor on crypto regulation and access to investment products.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.