The recent uptrend in the crypto market has injected fresh momentum into a wide range of assets. While Bitcoin (BTC) set the tone, some assets seized the spotlight to deliver standout performances, and among them was Myria (MYRIA).

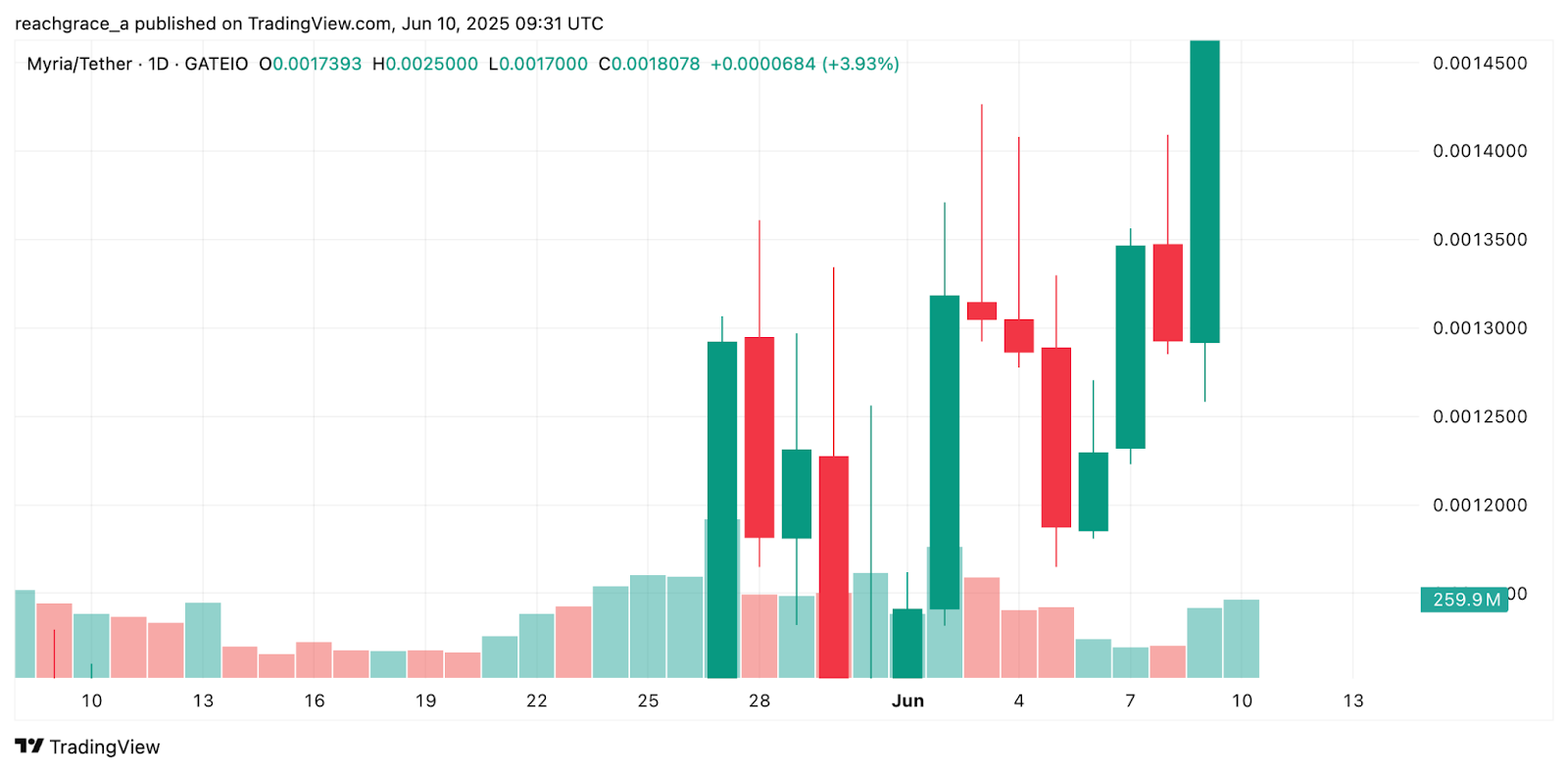

Myria (MYRIA), the native token of the Ethereum-based Layer-2 gaming platform, emerged as one of the top gainers during the latest crypto market uptick, soaring by 50% yesterday and up 5% in the past 24 hours. The surge brought the token to $0.00184, marking a 199.2% increase from its yearly low of $0.000615 and pushing it to new multi-month highs.

The rally was fueled by a sharp rise in trading activity. MYRIA’s 24-hour volume spiked by over 360%, propelling its market capitalization to approximately $59.5 million. The performance positioned MYRIA as a top-performing crypto asset, behind only a few others like PAYCOIN, which gained over 100%.

However, the token soon began relinquishing its gains in an inability to maintain the positive momentum, losing nearly 20% of its gains within a brief period. MYRIA trades at $0.001779 at press time, and its value now marks an approximate 88% decline from its all-time high of $0.0147.

Meanwhile, other tokens posted more modest but notable gains across the market. Bitcoin (BTC) led the charge with a 5% increase over 24 hours, briefly reclaiming the $110,000 level before dipping slightly to around $109,100. Altcoins including ETH, XRP, and SOL also rallied, posting gains between 4% and 8%.

Memecoins joined the trend with stronger numbers, and tokens including BONK, PEPE, WIF notched up to 10% in gains. While, like MYRIA, the majority of the crypto assets have also retraced part of their gains, overall market sentiment remains positive, fueling hopes for a sustained recovery.