Central Bank Governor Chea Serey revealed On May 28 that the Central Bank Digital Currency (CBDC) Bakong could increase the adoption of Cambodia’s Riel currency by facilitating cross-border QR payments.

Cambodia’s Central Bank Governor Asserts Cross-Border Transactions Can Boost Riel Use

In an exclusive interview at Nikkei’s Future of Asia conference in Tokyo, Chea Serey discussed the dynamics of Cambodia’s currency system and how it’s evolving.

At the occasion of the Nikkei Forum 29th Future of Asia, Secretary-General of ASEAN, Dr Kao Kim Hourn, met with the Governor of the National Bank of Cambodia (NBC), Dr Chea Serey.

They discussed the significant progress made in ASEAN digital payments integration, financial… pic.twitter.com/pmy8pQ0ybk

— ASEAN (@ASEAN) May 24, 2024

She revealed that over 80% of Cambodia’s economy still relies on the U.S. dollar as part of a dual-currency system. The government is trying to ensure citizens use the riel more for local transactions, however.

Cambodia’s central bank governor said that while the US dollar dominates physical transactions, the local currency (riel) is used more in digital transactions.

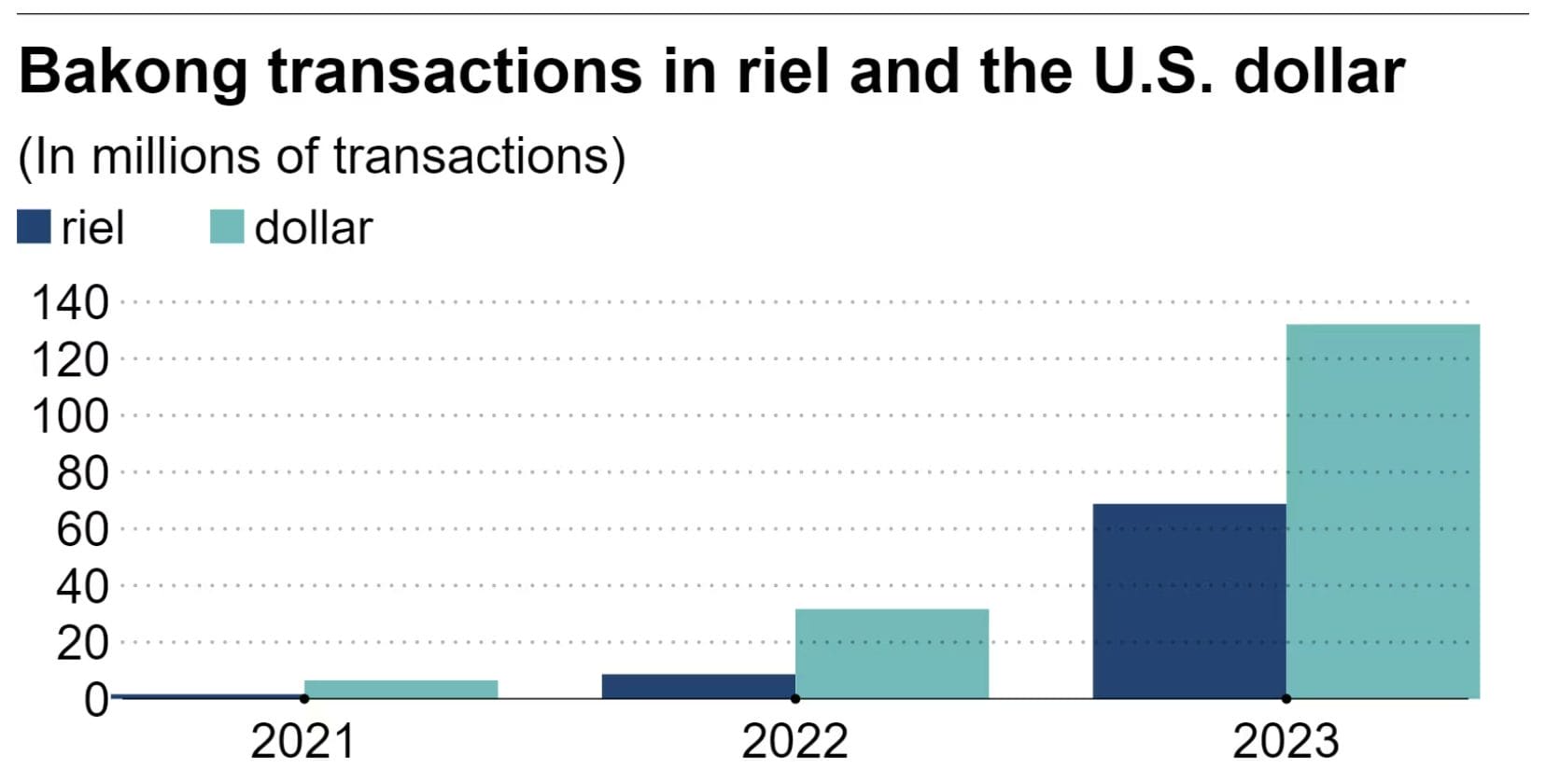

Since its launch in 2020, the Bakong CBDC has facilitated a total of $70 billion in digital payments as of 2023, a figure approximately double the country’s GDP.

Domestic Bakong CBDC transactions can be conducted in both riel and dollars, but the riel accounted for $20 billion of last year’s total, more than twice the value from 2022.

Serey further reiterated that cross-border transactions play an essential role in promoting the use of the riel. Bakong’s functionality extends to QR code-based payments between Cambodia, Thailand, Laos, and Vietnam, as well as transactions involving China’s UnionPay.

These cross-border payments exclusively use the riel, requiring Cambodian citizens to have a riel Bakong account to conduct transactions with neighboring countries.

Similarly, Thai tourists can only make QR code transactions in Cambodia if the merchants accept riel.

💥 Today, Cambodia officially announced the launch of their central bank digital currency (CBDC).

Guess who recently met with the Central Bank of Cambodia? #XRP #XRPCommunity #crypto #blockchain pic.twitter.com/vVut3ZTvNX

— Cryptic Poet (@1CrypticPoet) October 29, 2020

Bakong is different from other CBDCs because it’s backed by both the Cambodian riel and the US dollar. The dual support provides stability and broad usability within Cambodia’s unique dual-currency system, facilitating smoother transactions and financial integration.

Cambodia is not alone in exploring CBDC to strengthen its fiat currency. In March 2024, the Hong Kong central bank launched a wholesale CBDC to bolster tokenization and the financial strength of the city.

Additionally, the South Korean central bank is speeding up its CBDC project to test the digital Korean won (KRW) by the last quarter of 2024. This will be to test the usability and deposit function of the digital currency.

Cambodia’s Central Bank Plans to Initiate Bakong Transactions in India & Japan

Cambodia’s central bank governor revealed plans to launch cross-border payments using Bakong CBDC with India as early as June 2024 and is also exploring collaboration with Japan.

“We are open to working with other countries with significant people movement with Cambodia,” she said.

Potential collaboration with technologically advanced countries like Japan could bring technical expertise and innovations that enhance Bakong’s functionality and appeal. The collaboration could improve the payment system’s efficiency, security, and user experience, making the riel more attractive to domestic and international users.

From: cryptonews

Crypto News