Crypto investors suffered the biggest liquidation in over a week as Bitcoin and most altcoins continued their downtrend.

Bitcoin and altcoins liquidations rise

Data compiled by CoinGlass shows that total liquidations on Friday, Sep. 6, jumped to over $221 million, up from $72 million a day earlier. It was the biggest jump since Aug. 27 when liquidations soared to $281 million.

- Bitcoin (BTC), the biggest cryptocurrency, led the liquidations with over $114 million;

- Ethereum (ETH), $72 million worth and

- Solana (SOL), $14 million.

Bitcoin and other cryptocurrencies dropped as investors dumped risky assets and moved to safe havens. The tech-heavy Nasdaq 100 index dropped by over 500 points while the small-cap Russell 2000 index crashed by over 1.96%.

This decline happened after the U.S. published mixed jobs reports, signaling that the Federal Reserve will deliver a 0.25% cut instead of the expected 0.50%. The numbers showed that the unemployment rate fell slightly to 4.2% while wage growth bounced back.

There is a risk that Bitcoin and other altcoins may continue falling in the coming weeks. For one, a sense of fear is spreading in the market as the fear and greed index has fallen to the fear area of 30. In most periods, cryptocurrencies retreat when investors are fearful.

Bitcoin and Ethereum are also seeing weak institutional demand as their ETFs have continued their outflows. Data shows that Bitcoin ETFs have shed assets in the past eight consecutive days while Ether funds have shed over $568 million since inception.

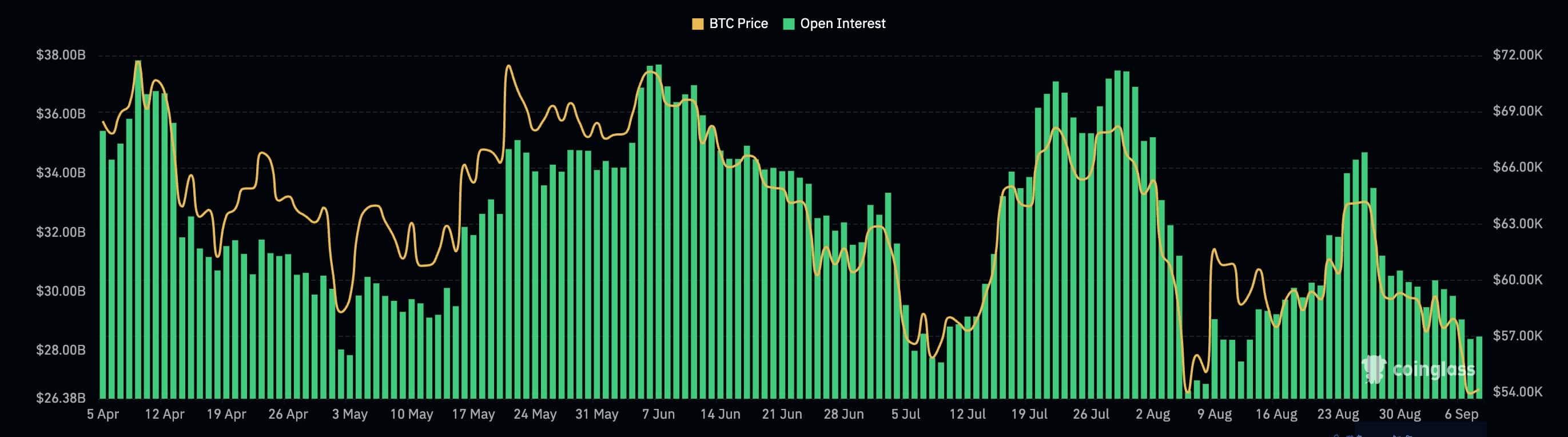

Additional data shows that the futures open interest continued falling and is hovering at its lowest point in over a month. Bitcoin’s open interest dropped to $28.4 billion, down from the year-to-date high of over $37 billion.

Bitcoin price has weak technicals

Bitcoin Death Cross?

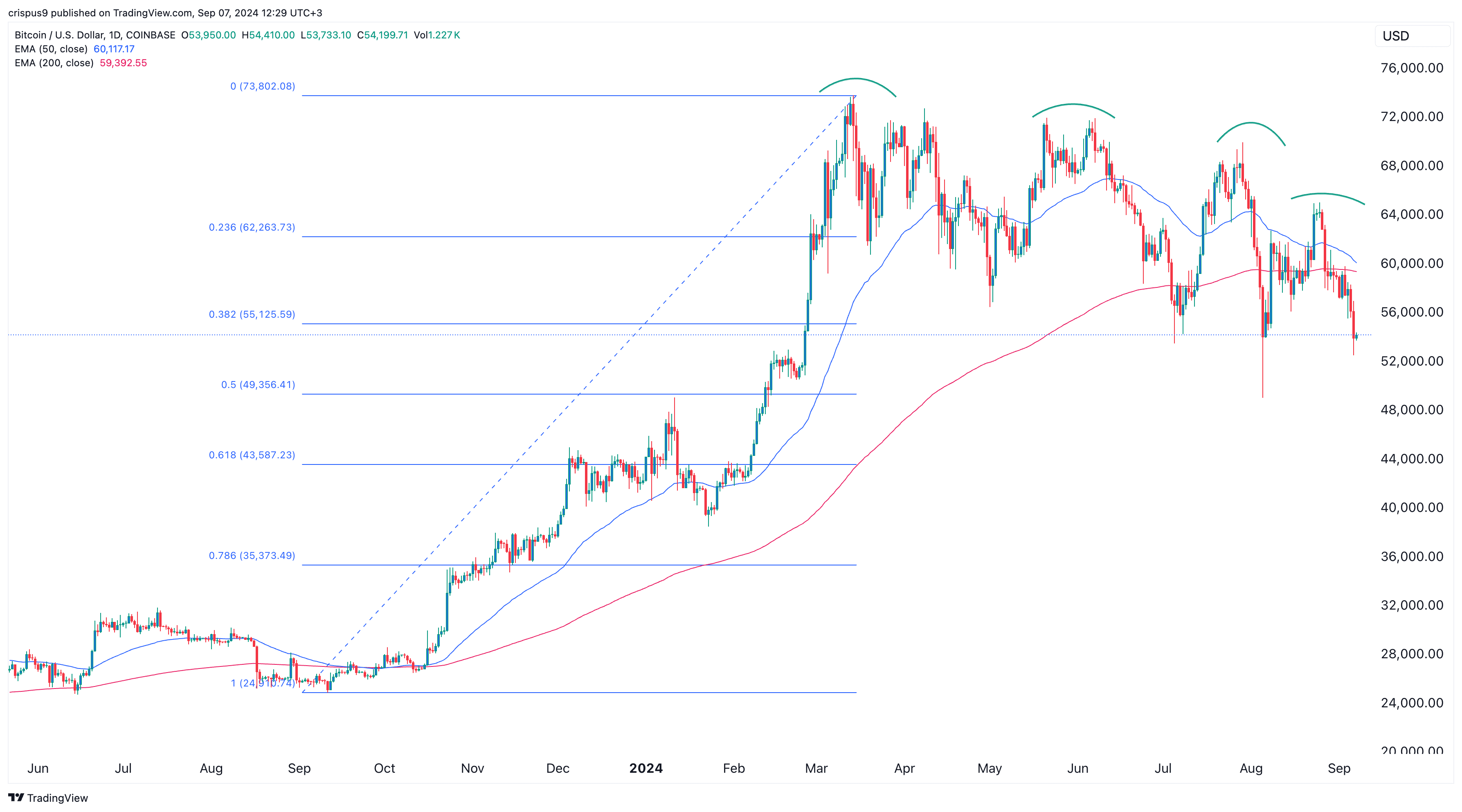

Technically, there is a risk that Bitcoin is about to form a death cross pattern as the spread between the 200-day and 50-day Exponential Moving Averages is narrowing.

The last time Bitcoin formed a death cross was in 2022. The event led to a 65% crash.

Bitcoin has also moved below the 38.2% Fibonacci Retracement point, meaning that it could drop to the 50% level of $49,000, its lowest level last month. A drop below that point will lead to more downside. Other altcoins tend to crash when BTC is not doing well.

From: crypto.news

Crypto News