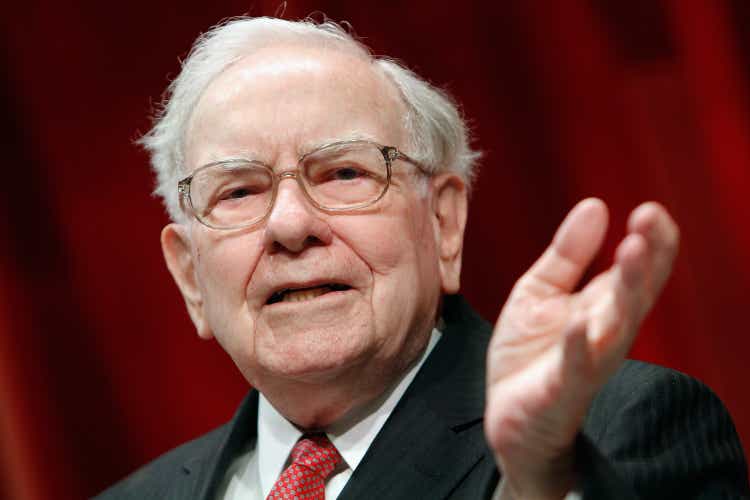

Paul Morigi/Getty Images Entertainment

Berkshire Hathaway Inc (NYSE:BRK.B) continued gains for a seventh straight session, as the stock closed 1.57% higher at $475.71 on Friday.

The Nebraska based conglomerate holding company gained 4.31% in the preceding six sessions. The stock has gained 31.9% so far this year, compared to about 17% rise in the broader S&P 500 Index.

BRK.B is up 9% over the past one month. The stock closed 0.81% higher on Thursday at $468.37.

Seeking Alpha’s Quant rating has given the stock a rating of STRONG BUY with a score of 4.98 out of 5. The company has received A+ in terms of profitability and revisions, and C- on valuation.

Among the Wall Street analysts, 2 analysts recommend a STRONG BUY, 2 analysts recommend to HOLD the stock, while none of the analysts recommend SELL.

Seeking Alpha analysts are also bullish on the stock and have rated the stock a BUY.

Berkshire Hathaway (BRK.B) joined the ranks of companies with market cap topping $1T in Wednesday morning trading, making the investment behemoth the first non-tech company to reach that level.

Analyst Daniel Jones believes that though shares of Berkshire are a bit outside of their historical valuation range, they are still likely appealing for long-term, value-oriented investors, adding that the company’s revenue and profits have been strong, with insurance operations driving much of the growth.

On the other hand, REITer’s Digest downgraded its rating to HOLD for Berkshire stock, given its current valuation at 1.63x book value and recent rapid appreciation.

“Berkshire’s significant reduction in its Apple holdings and the accumulation of cash raise concerns about finding future investment opportunities amid increasing private equity dry powder,” REITer’s Digest added.