Crypto funds recorded a fourth consecutive week of outflows, with $173 million withdrawn, according to CoinShares’ latest weekly fund flows report.

Summary

- Digital asset investment products saw $173 million in outflows, marking a fourth consecutive week of withdrawals and bringing the four-week total to $3.74 billion.

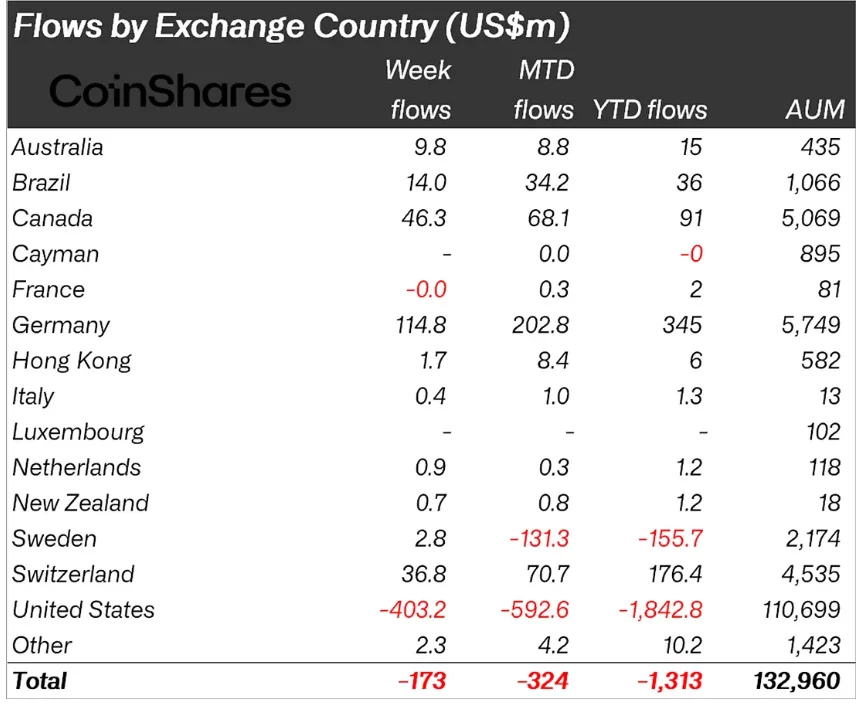

- The US led the downturn with $403 million in outflows, while Europe and Canada recorded $230 million in combined inflows, highlighting sharp regional divergence.

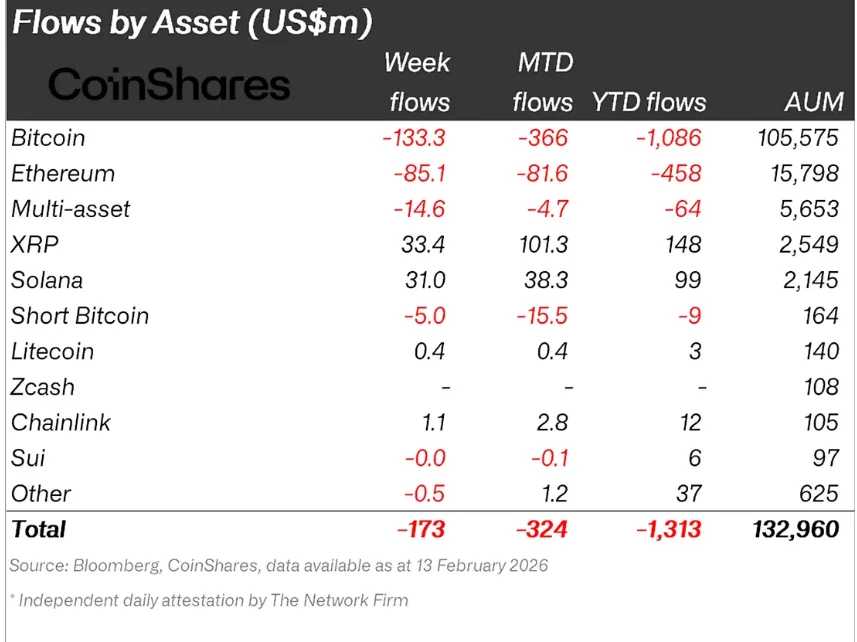

- Bitcoin and Ethereum bore the brunt of selling, while XRP and Solana continued to attract capital.

The latest decline brings total outflows over the past four weeks to $3.74 billion, underscoring persistent investor caution amid price weakness and macro uncertainty.

The week began on a stronger footing, with $575 million in inflows, but sentiment quickly reversed. Midweek outflows reached $853 million, likely driven by further downside in crypto prices. Conditions improved slightly on Friday after weaker-than-expected US CPI data, which helped trigger $105 million in inflows.

Trading activity also cooled. Exchange-traded product (ETP) volumes fell sharply to $27 billion, down from a record $63 billion the previous week.

US leads crypto fund outflows as Europe and Canada diverge

Regional data revealed a stark divergence in sentiment. The United States accounted for $403 million in outflows, while other regions collectively posted $230 million in inflows.

Germany led with $115 million in inflows, followed by Canada ($46.3 million) and Switzerland ($36.8 million). The data suggests that while US investors remain risk-off, appetite for digital assets persists in parts of Europe and North America.

Bitcoin and Ethereum under pressure, altcoins show resilience

Bitcoin (BTC) bore the brunt of the sell-off, with $133 million in outflows last week. Ethereum (ETH) followed with $85.1 million in withdrawals.

Interestingly, short Bitcoin products also saw outflows totaling $15.4 million over the past two weeks, a pattern CoinShares notes is often observed near potential market bottoms.

In contrast, select altcoins continued to attract capital. The Ripple token (XRP) led with $33.4 million in inflows, followed closely by Solana (SOL) and Chainlink (LINK). The selective resilience suggests investors are rotating exposure rather than exiting the asset class entirely.

Despite the recent drawdown, total assets under management remain substantial, highlighting that institutional engagement in digital assets continues even amid short-term volatility.