In its latest Market Byte research note, Grayscale Investments highlights a meaningful shift in Bitcoin’s price behavior. Recent BTC trading patterns resemble growth assets more closely than safe-haven commodities like gold, challenging the long-standing “digital gold” narrative.

Summary

- Bitcoin is trading more like a growth asset than gold, with recent price action closely tracking high-growth software stocks and broader risk assets, according to Grayscale.

- Near-term BTC moves are being driven by risk sentiment, not store-of-value demand, limiting its effectiveness as a hedge during equity market drawdowns.

- Grayscale maintains a long-term bullish thesis, arguing Bitcoin could eventually evolve into a gold-like monetary asset with lower volatility and weaker equity correlations if adoption continues.

According to the report’s key takeaways, Bitcoin’s (BTC) sharp move lower in early February — where the price dipped to around $60,000 on February 5 before a modest bounce — was driven by correlation with broader risk assets rather than traditional store-of-value flows.

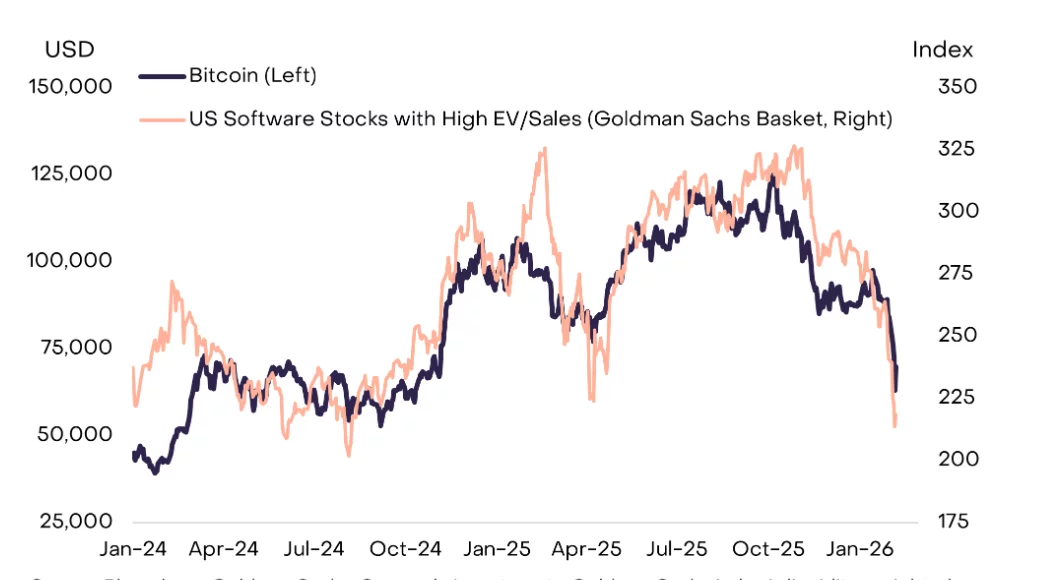

Grayscale’s research shows Bitcoin’s price movements have tracked high-growth software stocks closely, especially since early 2024, with both falling in sync during recent sell-offs.

This behavior ushows Bitcoin’s sensitivity to market sentiment and cyclical risk appetite, similar to technology or growth equity performance during sell-offs.

What this means for Bitcoin traders

For traders, this means treating BTC more like a beta-driven risk asset in the near term. Rather than acting as a hedge during turbulent markets, Bitcoin has recently declined alongside broader speculative assets and failed to demonstrate the safe-haven characteristics typically associated with gold.

This shift has practical implications for portfolio construction and risk management. Traditional strategies that lean on Bitcoin as a hedge against macro uncertainty or inflation may be less effective when BTC behaves in sync with growth asset risk cycles.

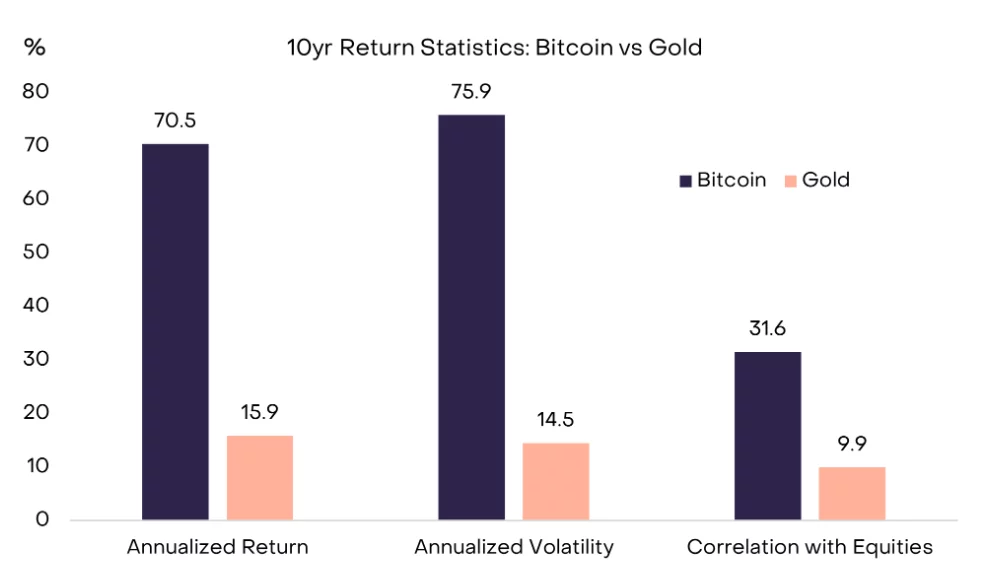

Grayscale stresses that Bitcoin has not yet achieved gold-like status as a monetary asset, and that gap is central to the investment thesis.

However, in a future economy shaped by AI agents, humanoid robots, and tokenized capital markets, the firm argues a digital, blockchain-based commodity like Bitcoin is better suited to become the dominant store of value than physical assets such as gold or silver.

Grayscale adds that if Bitcoin succeeds in this role over the long term, its return profile could eventually shift. Price behavior may begin to resemble gold rather than growth stocks, marked by lower volatility, weaker equity correlations, and more stable — though lower — expected returns.