CryptoQuant founder Ki Young Ju stated that sellers may soon dominate the market if buying pressure from Strategy and spot Bitcoin ETFs cool off, leading to price pressure.

Summary

- CryptoQuant analysts revealed that Bitcoin whales have been cashing in on BTC holdings ever since the price hit $100,000. But strong buying from institutions like Strategy and spot ETFs have kept prices afloat around $105,000.

- Despite the heavy whale sell-offs, CryptoQuant noted that short-term holders and institutional investors are steadily accumulating Bitcoin, hinting that the market could stabilize soon. Though it is still in a temporarily bearish phase.

In a recent post, CryptoQuant founder Ki Young Ju noted that large Bitcoin holders have been “cashing out” in billions ever since the token hit $100,000. At the moment, the token’s price has managed to rebound from its previous dip below $100,000 and is now trading around $105,000.

Ju stated that the bull cycle should have ended in early 2025, but it was sustained temporarily by fresh buying power from major players in the BTC market like Michael Saylor’s Strategy and Bitcoin spot ETFs. Data from SoSoValue shows that BTC spot ETFs have seen $1.15 million in daily inflows, recovering from its previous outflow slump.

Because of the support from these large institutional-level buyers, the market was able to soak up selling pressure from whales and keep prices afloat.

However, if Strategy’s Bitcoin (BTC) purchase spree subsides and accumulation of Bitcoin ETFs slow down, then the market could shift in favor of the sellers who are already making big moves as of late. Ju predicts that sellers could once again dominate the market if large buyers loosen their grip.

“There is still heavy selling pressure, but if you think the macro outlook is strong, it is a good time to buy [Bitcoin],” said Ju.

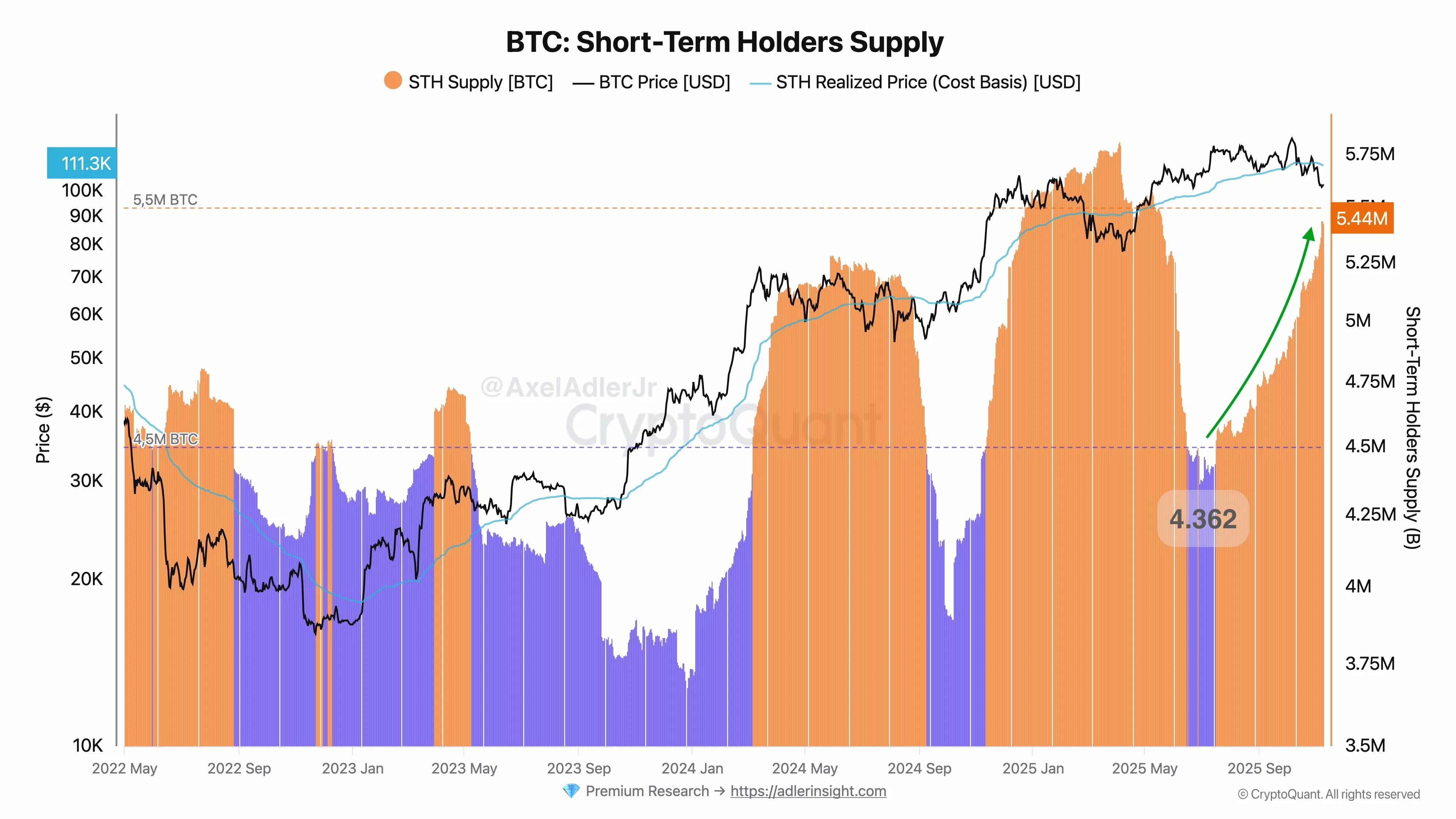

However, buyers continue to defend their ground as indicated by recent on-chain activity. According to another CryptoQuant analyst, Axel Adler Jr., short-term Bitcoin holders have increased their combined BTC holdings from 1 million BTC to 5.4 million BTC, indicating a 24.7% increase since August this year.

“Despite the coins being at a loss, new investors continue to accumulate,” said Adler Jr, hinting that traders may be buying the dip as prices stabilize.

In addition, Adler Jr also noted that the Bitcoin network continues to generate an average quarterly profit of $1 billion per day. This means that holders still get modest gains from the token even though it has been on a downturn trend lately.

What is CryptoQuant’s outlook for Bitcoin?

Back in March 2025, CryptoQuant founder Ki Young Ju predicted that the bull cycle has ended. He told traders to anticipate a bearish market or sideways price action within the next six to 12 months. However, this prophecy did not come to pass, as the Bitcoin saw consecutive all-time highs within this year.

Not only that, BTC even managed to reach a new all-time high at the beginning of October, skyrocketing to about $126,080. The price of BTC now stands nearly 17% below its highest peak. Ju said that it is currently a good time to buy Bitcoin, if traders believe that macroeconomic outlook would hold up the price in the near-future.

On the other hand, if broader economic conditions worsen or institutional buying power dries up, then Bitcoin could be facing another period of downward pressure, which would lead to the price declining or trading sideways.

At the moment, Bitcoin is currently trading hands at around $105,123. Technical indicators point to more short-term consolidation after rebounding from its previous drop below $100,000.

So far, the price has managed to reclaim its place above the 30-day moving average which sits at around $105,836. This indicates mild bullish momentum, but the lack of a clear breakout above $107,000 to $108,000 zone could signal continued resistance. In line with Ki Young Ju’s observation, sellers remain active while whales continue to distribute BTC.