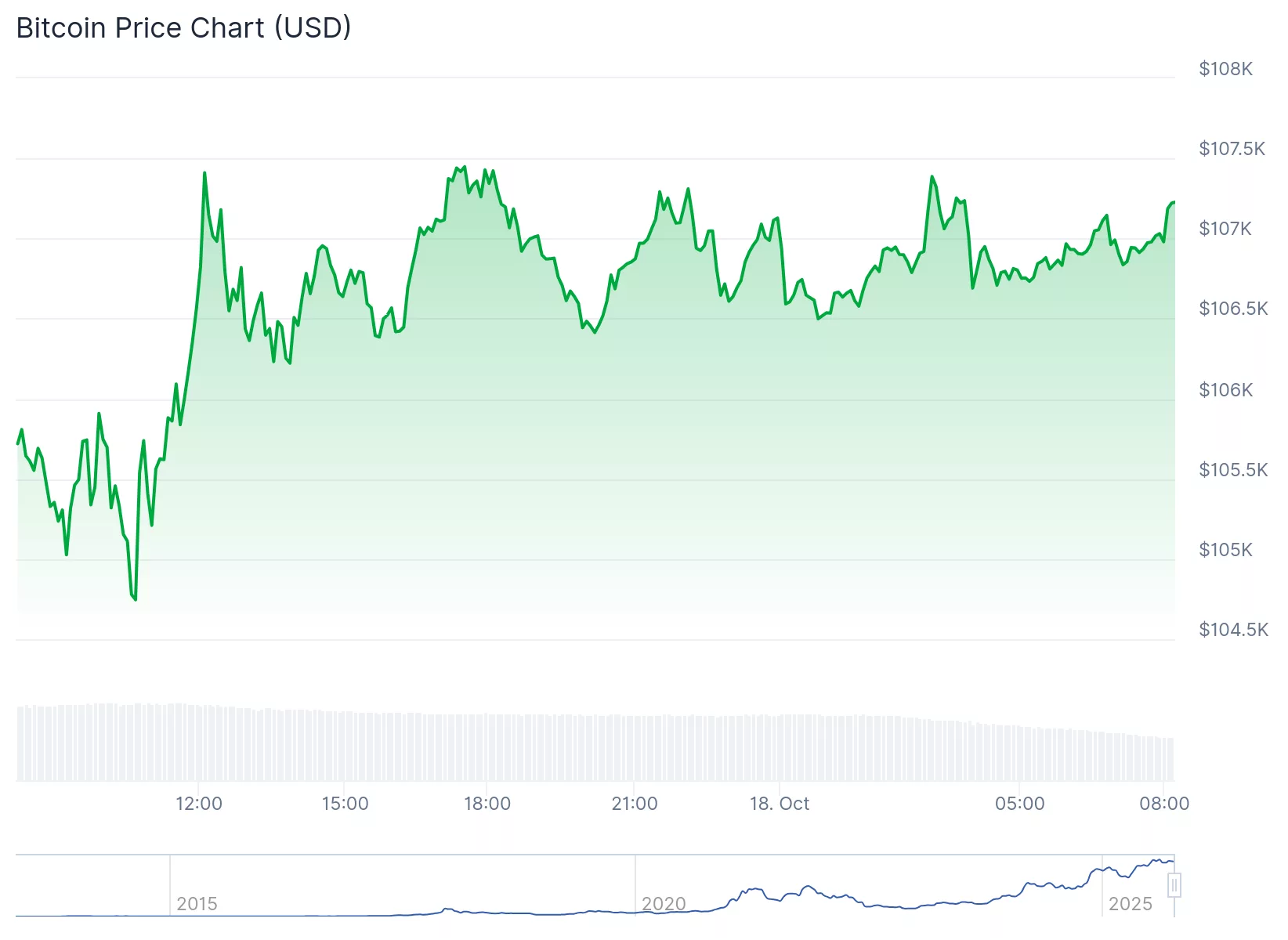

Bitcoin hovered above $107,200 at last check Saturday, rebounding from its weekly low of $103,660.

The rally lifted several major cryptocurrencies — including Dash, Morpho, Bittensor, and Aster — all of which gained more than 8% in the past 24 hours.

Summary

- The bounce in digital assets comes as investors “buy the dip” following a broad crypto selloff earlier this month and amid growing hopes of a thaw in U.S.-China relations.

- Markets are watching closely ahead of Trump’s expected meeting with President Xi at the APEC summit, with Treasury Secretary Scott Bessent slated to meet his counterpart Le Lifeng next week in Malaysia.

- Any sign of de-escalation could ease inflationary pressures and keep the Federal Reserve on its rate-cutting path — a scenario traders see as bullish for both stocks and cryptocurrencies.

Bitcoin and ‘buy the dip’ sentiment

One potential reason for the uptick in Bitcoin price is that investors are buying the dip after most tokens moved into a bear market, plunging by over 20% from their highest point this month.

The crypto market is also bouncing back as hopes that the U.S. and China will de-escalate ahead of President Donald Trump’s meeting with President Xi Jinping at the Asia-Pacific Economic Cooperation (APEC) summit in South Korea later this month.

Treasury Secretary Scott Bessent, after clashing with Li Chenggang, China’s top trade negotiator, confirmed that he spoke with He Lifeng, his Chinese counterpart in Malaysia, on Friday and planned to meet in person next week.

Trade relations between the two countries have gotten tense. As of last month, China’s average tariffs on U.S. exports are over 32% and cover 100 percent of all goods.

It has also announced a plan to implement export controls on rare earth materials and magnets. Such a move would impact U.S. manufacturing, as the country holds over 80% of the market share.

China has stopped importing U.S. soybeans, asked its companies to avoid Nvidia chips, and started an investigation into Qualcomm. For his part, Trump is threatening to impose tariffs beginning at 130% on Chinese exports by Nov. 1, up from the 30% minimum rate currently in effect.

A potential deal between the two countries would be bullish for the stock and crypto markets. For one, it would lower the tensions that have existed in the past few weeks.

Additionally, a deal would help to reduce the inflation risk, ensuring that the Federal Reserve continues cutting interest rates.

Crypto rally could be a dead-cat bounce

According to Bloomberg, Chinese officials told their global counterparts that the rare earths measure was taken as a response to U.S. provocations.

They pointed to U.S. measures to expand sanctions to capture subsidiaries of blacklisted companies.

Still, there is also a risk that the ongoing crypto market rally is a dead-cat bounce, or DCB. A DCB is a situation where an asset in a free fall bounces back temporarily and then resumes its downtrend.

A good example of a DCB is what happened last week when Bitcoin and other altcoins after last week’s crash. Most of them rebounded after Friday’s crash and then resumed the downtrend.