As Bitcoin ETFs saw their first trickle of outflows in days, investors sought safety elsewhere — driving the Swiss franc higher and pushing gold to the edge of a new record.

Summary

- Bitcoin, gold, and the Swiss franc are emerging as key safe-haven assets amid escalating U.S.–China trade tensions and a sharp downturn in equities. The Swiss franc surged to 1.2500 against the dollar, gold neared a record high at $4,017, and Bitcoin rebounded to $112,800 after briefly dipping to $107,000.

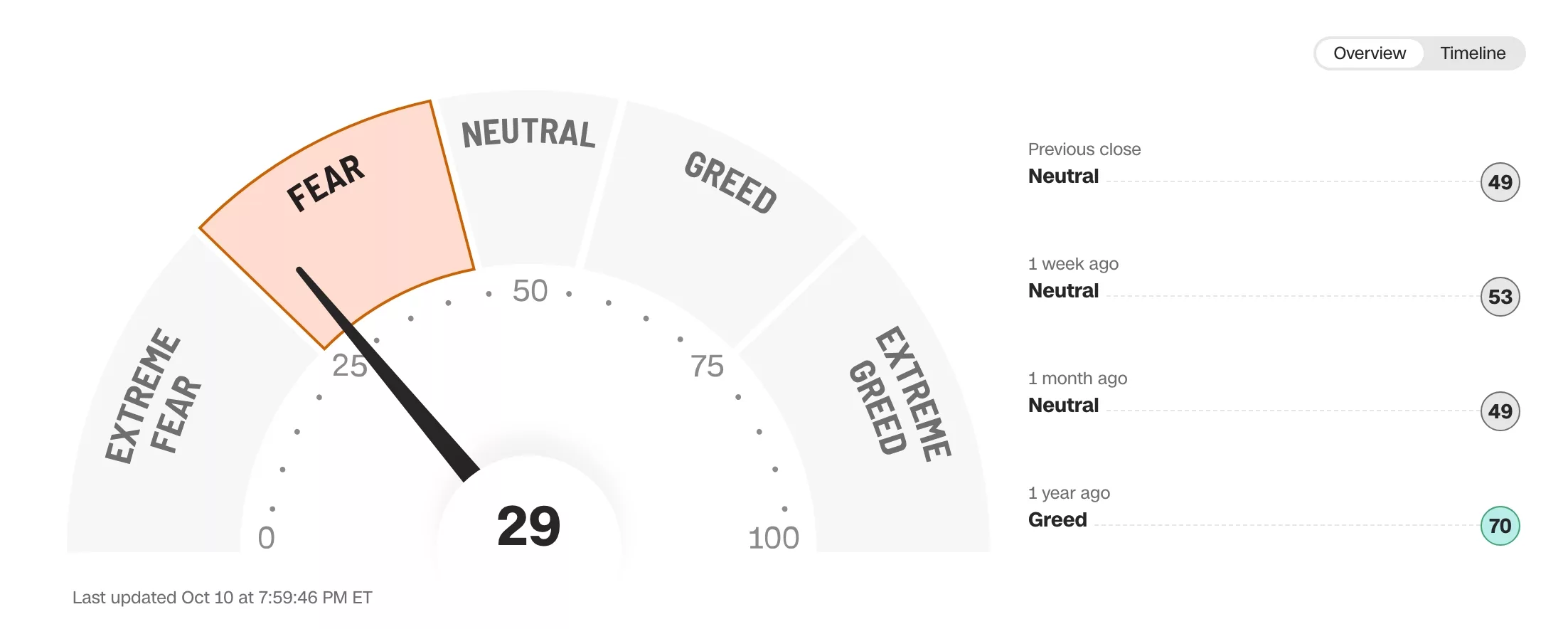

- Despite Friday’s modest $4.5 million outflow from spot Bitcoin ETFs, the products still posted a $2.7 billion weekly gain, bringing cumulative inflows above $62.7 billion — far outpacing the $1.7 billion outflow from the SPDR S&P 500 ETF. Major U.S. indices dropped over 2% as the Fear and Greed Index plunged from 53 to 29, signaling mounting investor anxiety.

- Analysts say the resilience of BTC, gold, and the franc reflects investor flight to assets with limited supply, central bank demand, and economic neutrality — traits that continue to define them as modern safe havens in times of market turmoil.

Safe haven assets

Bitcoin, gold, and Swiss franc have emerged as solid safe-haven assets as the stock market and the Fear and Greed Index plunge following the latest trade escalation.

The Swiss franc surged to 1.2500 against the US dollar from 1.2390 earlier this week. It also jumped to a multi-month high of 1.0763 from the September low of 1.0587.

Gold price jumped to $4,017, a few points below the all-time high of $4,053. Bitcoin (BTC), on the other hand, initially dropped to $107,000 and then bounced back to $112,800.

Most importantly, the net outflow from spot Bitcoin ETFs was just $4.5 million on Friday. Despite this outflow, the funds scored a weekly gain of $2.7 billion, bringing the cumulative total to over $62.7 billion.

Bitcoin’s ETF outflow was also much lower than the $1.7 billion of the SPDR S&P 500 ETF. Additionally, the S&P 500, Nasdaq 100, and Dow Jones indices experienced a steep decline, falling by over 2%.

BTC, gold, and Swiss franc held steady as the Fear and Greed Index tumbled to the fear zone of 29. It was at the neutral zone of 53 a week ago.

The index dropped as the market volatility gauge moved to extreme fear, with the VIX hitting 23. Additionally, demand for safe-haven and junk bonds spiked.

All this happened as the trade relations between the U.S. and China worsened. President Donald Trump placed a “massive increase” in tariffs on Chinese imports. China followed up by announcing a series of measures, including export controls and tariffs.

Why BTC, gold, and CHFF are safe haven assets

Bitcoin is widely regarded as a safe-haven asset due to its tokenomics. It has a supply limit of 21 million, is in high demand, and the supply squeeze is continuing. The supply of Bitcoin on exchanges has plummeted to a multi-year low, as companies and ETFs continue to buy.

Gold is also a major haven because many central banks have continued to accumulate it. Global central banks have purchased 900 tons of gold this year, and for the first time since 1996, they now hold more of it than U.S. Treasury securities.