Aster token price holds steady near $1.70 support as USD inflows rise, with key confluences suggesting a potential bullish move toward $3 resistance.

Summary

- $1.70 region aligns with VWAP, 0.618 Fibonacci, and a structural higher low.

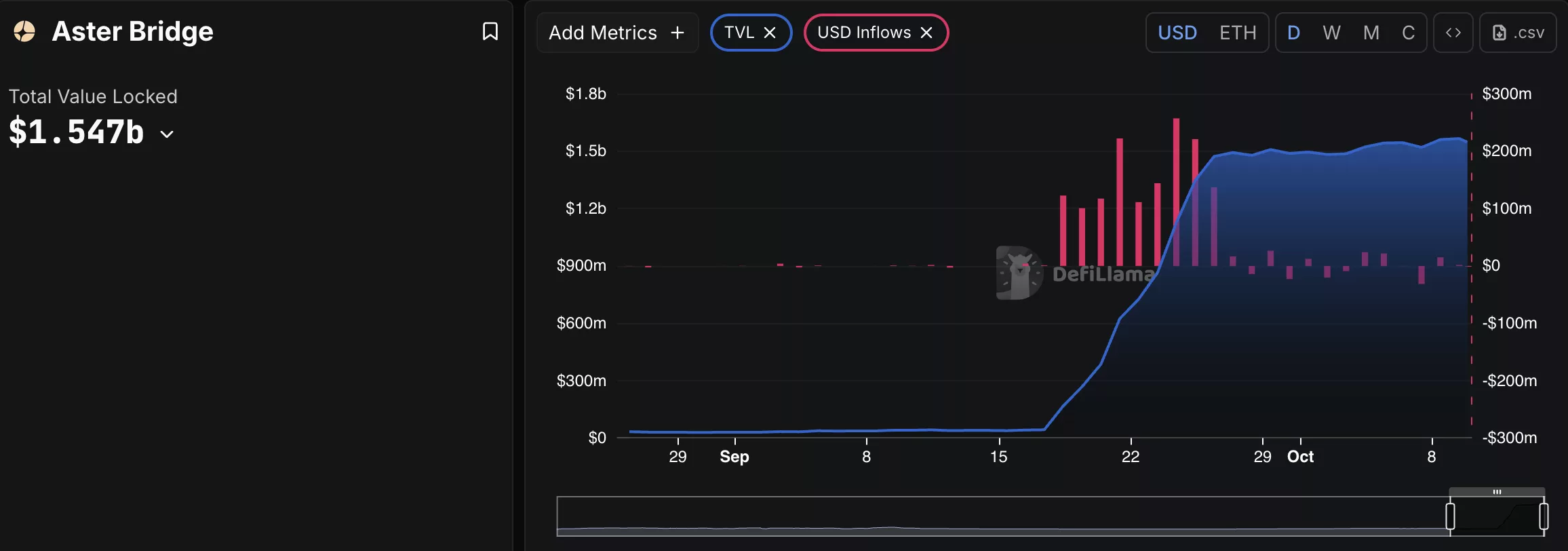

- USD inflows show increasing demand and ecosystem growth.

- Price structure remains bullish, targeting a move toward $3 resistance.

The Aster (ASTER) recent price pullback has brought it to a structurally important support zone at $1.70, a region that has historically acted as a launch point for major bullish moves. The asset is trading within a higher time frame ascending channel, where each corrective phase has consistently led to the formation of a higher low before continuing.

As such, the current consolidation near $1.70 appears to be another healthy retracement within a broader bullish trend. Adding to market optimism, Aster’s CEO recently outlined plans for the upcoming chain launch, token buyback initiatives, and the project’s long-term vision, reinforcing confidence in its growth trajectory.

Aster token price key technical points

- Key Support: $1.70 region aligns with VWAP, the 0.618 Fibonacci retracement, and a structural higher low.

- USD Inflows Rising: Increasing USD inflows suggest sustained demand and growing market participation.

- Upside Target: Continuation above this level could trigger a rotation toward $3 resistance and beyond.

From a structural standpoint, the $1.70 support level represents a pivotal zone for Aster. This area coincides with multiple layers of confluence: the volume-weighted average price (VWAP), the 0.618 Fibonacci retracement of the previous leg higher, and the formation of a new higher low in the market structure. Historically, such technical alignments have served as strong bases for trend continuation.

The Aster token’s price action has remained constructive despite the pullback, with the recent correction appearing more as a reset in momentum rather than a reversal. The consolidation near this support level reflects an equilibrium phase, where buyers and sellers are balancing before a potential expansion in volatility.

As long as Aster maintains structure above the $1.70 region, the probability of a bullish rotation remains high, with the next major resistance target positioned near $3.

On-chain data supports this bullish outlook. Over the past two weeks, USD inflows into Aster have increased significantly, indicating heightened investor interest and capital rotation into the ecosystem. Rising inflows typically correspond to growing transactional activity and liquidity, which strengthens the foundation for sustained price movement.

This uptick in on-chain engagement highlights that demand for Aster’s utility is expanding relative to peers, providing a competitive advantage within its sector.

Volume analysis further reinforces this bullish narrative. The increasing buy-side volume near support levels shows that accumulation is occurring, rather than broad distribution. As this demand consolidates and sellers become exhausted, the stage is set for a potential rally that could test and possibly breach the $3 region.

What to expect in the coming price action

If Aster continues to hold above the $1.70 support and confirms a higher low, a move toward $2.50–$3 becomes increasingly likely. Sustained volume and consistent USD inflows will be key catalysts for this breakout.