Morgan Stanley has outlined new allocation limits for cryptocurrencies in client portfolios as it prepares to open the door for retail crypto trading next year.

Summary

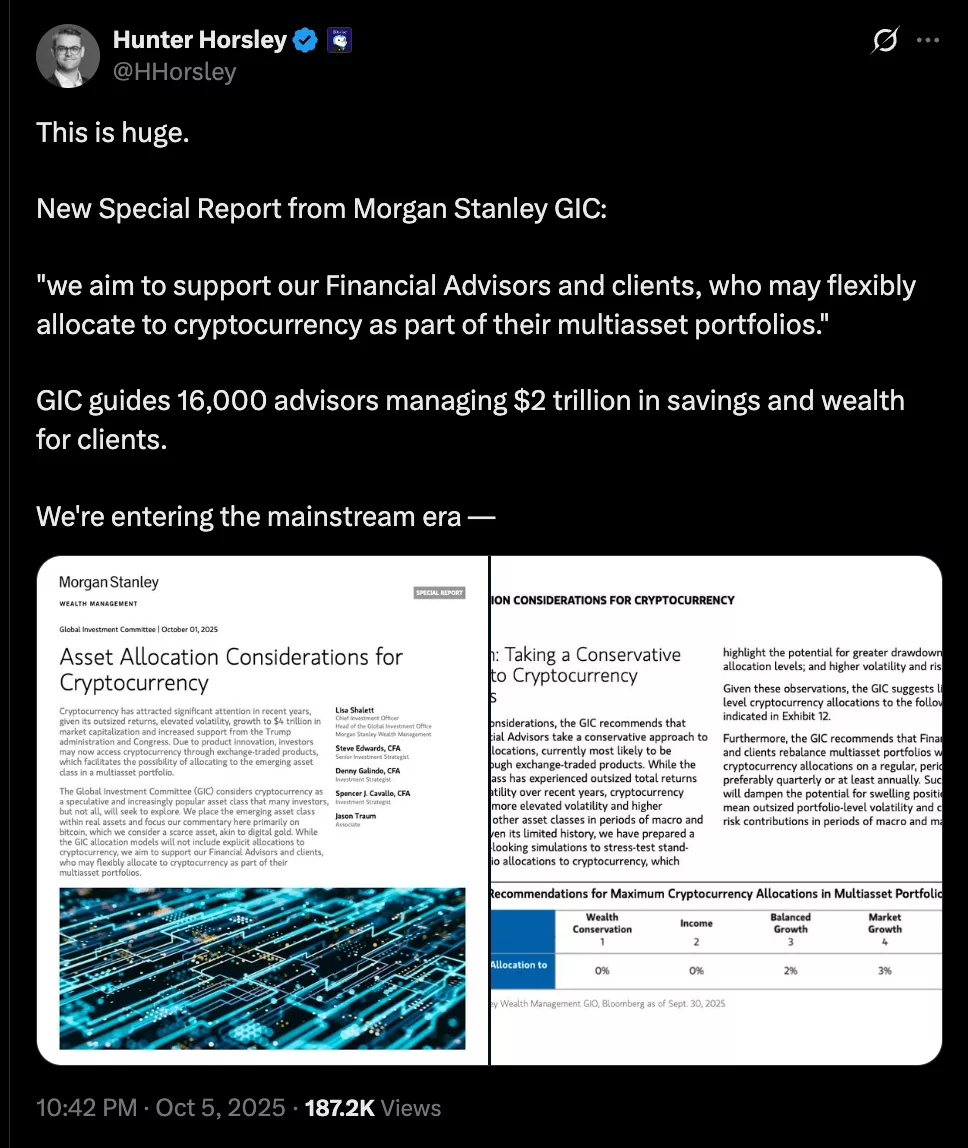

- Morgan Stanley analysts are recommending up to 4% crypto allocation in select client portfolios.

- The financial services giant said Bitcoin can be considered as digital gold.

- Morgan Stanley is looking to offer retail crypto trading via its subsidiary E-Trade.

In an October Global Investment Committee report, Morgan Stanley analysts recommended conservative exposure for its model portfolios of 1% to 2% for income and balanced growth strategies, and up to 4% for portfolios focused on “opportunistic growth.”

“While the GIC allocation models will not include explicit allocations to cryptocurrency, we aim to support our Financial Advisors and clients, who may flexibly allocate to cryptocurrency as part of their multi-asset portfolios,” the report said.

Morgan Stanley analysts are primarily focused on Bitcoin, as they believe it is a scarce asset that is “akin to digital gold,” offering long-term value in diversified portfolios. At the same time, they advised financial advisors to take a “conservative approach” given the asset class’s history of volatility and its tendency to move in step with broader markets during times of stress.

“GIC recommends that Financial Advisors and clients rebalance multi-asset portfolios with cryptocurrency allocations on a regular, periodic basis: preferably quarterly or at least annually,” the authors wrote, adding that rebalancing could help keep risk in line with portfolio objectives and prevent outsized exposure to a single asset class over time.

Commenting on the development, Bitwise CEO Hunter Horsley noted that cryptocurrencies were entering the “mainstream era,” calling the report a “huge” development.

Morgan Stanly eyes crypto trading in 2026

Morgan Stanley has called for a measured allocation and disciplined portfolio management approach, as institutions are increasingly embracing Bitcoin as a treasury asset and a long-term store of value. The flagship cryptocurrency has recently hit a new all-time high above $125,000, driven by this institutional demand, and retail investors haven’t hesitated to follow.

The financial services giant is also working on plans to capitalize on this demand and is working to introduce crypto trading through its discount brokerage platform E-Trade, which it acquired in 2020.

To develop the platform, Morgan Stanley has partnered with crypto startup Zerohash, but the exact details of the integration and product rollout timeline have yet to be finalized. Initial reports suggest a 2026 launch.